Advertisement|Remove ads.

Amber Enterprises Gains On Unitronics Acquisition, Strong Q1, But SEBI RA Notes Bearish Signals Ahead

Amber Enterprises India has been in the spotlight lately. On Monday, IL JIN Electronics, the electronic unit of Amber Group, said it will acquire a controlling stake in Israel-based industrial automation and control systems, Unitronics, for over ₹400 crore in an all-cash deal.

It also posted a strong set of numbers for the June quarter, with consolidated net profit rising 44% to ₹104 crore, while revenue also grew 44% to ₹3,449 crore.

In early trade on Wednesday, Amber shares extended their rally into a third day, gaining 1.5% at ₹7,931.

However, despite the impressive operational performance in Q1FY26, technical signals indicate bearish undertones, with the recent rally losing steam, noted SEBI-registered analyst Rajneesh Sharma.

The stock recently tested ₹7,833, a key swing high that aligns with the upper boundary of a rising price channel, Sharma said.

While the weekly candle remains bullish, the Relative Strength Index (RSI) shows bearish divergence, as the stock price reached higher highs, but momentum failed to confirm. This divergence could hint at a near-term consolidation or pullback unless a breakout occurs with volume confirmation, the analyst added.

On the downside, key support levels lie at ₹7,147, a deeper ₹6,218, and further lower at ₹5,426. These levels are key to determining the short-term trend, Sharma said.

Q1 Earnings Summary

EBITDA grew to ₹28,637 lakh, supported by operating leverage. Segment-wise, consumer durables contributed around 76% of revenue, driven by strong seasonal demand.

The electronics division doubled its revenue to ₹76,630 lakh with improved margins from backward integration. The railway and defense segment posted ₹12,279 lakh and remains focused on scaling via AT Railway and new projects.

Looking ahead, management maintains its double-digit growth outlook for FY26, citing festive demand, export tailwinds, and a ₹2,500 crore fundraise to support expansion.

Strategic moves like the acquisition of Power-One Micro Systems and stakes in Unitronics and Ascent-K Circuit align with its clean energy, automation, and tech manufacturing ambitions, the analyst stated.

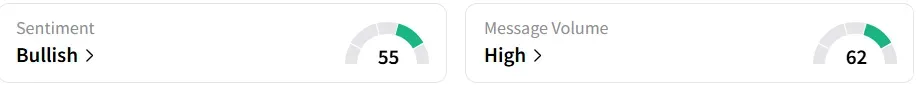

Sentiment improved to ‘bullish’ from ‘neutral’ a day earlier, while chatter also increased on Stocktwits.

Year-to-date, the stock has gained over 5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)