Advertisement|Remove ads.

AMC Entertainment Stock In Focus After Q3 Earnings: Retail Turns Cautious

Shares of movie theater company AMC Entertainment ($AMC) were down 4.4% (10:44 am ET) on Thursday after the company reported narrower third-quarter loss per share and upbeat earnings per share (EPS). However, the results failed to revive retail sentiment.

For the third quarter, AMC swung to a net loss of $20.7 million compared to a profit of $12.3 million for the same period last year. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) stood at $161.8 million compared to $199.9 million for Q3 2023.

The company reported an earnings loss of $0.04 compared to an estimated loss of $0.09. However, Q3 revenues came in at $1.35 billion, beating the consensus estimates of $1.33 billion.

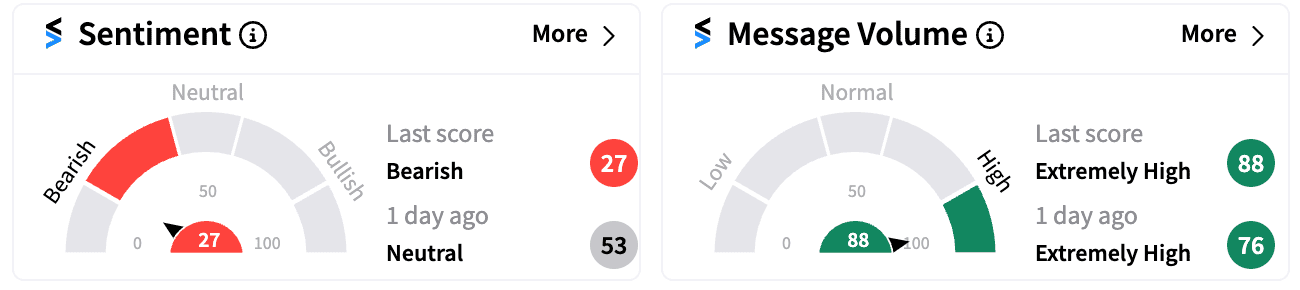

Retail sentiment for the stock turned ‘bearish’ (27/100) from ‘neutral’(53/100) a day ago, accompanied by ‘extremely high’ message volumes.

“Admittedly, some of our third quarter metrics of 2024 were behind those of last year. However, we believe of much greater importance is our bullishness about the impressive movie slate that is coming to our theaters in November and December of 2024, and continuing in 2025 and again in 2026,” Adam Aron, Chairman and CEO of AMC Entertainment, said in a statement. “Based on what we know now, we expect that the industry-wide box office should markedly rise at year-end and rise yet again for the next two years.”

Research firm B. Riley lowered AMC’s price target to $6 from $8 but kept a neutral rating on the shares, The Fly reported citing an analyst note. “The company's Q3 results exceeded consensus estimates for both revenues and adjusted EBITDA as the domestic circuit continued to demonstrate strong post-pandemic box office and moviegoer monetization outperformance,” said the note.

According to the company statement, it has made efforts towards cutting down its long-term debt, including “a series of transactions to extend the maturity of approximately $2.4 billion of its debt due 2026 to 2029 and 2030. Thus far in 2024, the total principal amount of corporate borrowings and finance leases has been cut by $349 million, it said.

Separately, AMC said it will launch “extra-large” screens with 4K laser projection at AMC auditoriums in early 2025, with an aim to make them available at 200 to 250 US locations.

To be sure, some Stocktwits users were optimistic on the stock even as many were skeptical about the fortunes of movie theaters turning around.

AMC stock is down 28.56% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Goldman_Sachs_resized_c6a47f630c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)