Advertisement|Remove ads.

AMC Vs. Cinemark: Retail Picks Potential Winner Among Movie Theater Chain Stocks

The fourth-quarter earnings reports from movie theater chains AMC Entertainment Holdings, Inc. (AMC) and Cinemark Holdings, Inc. (CNK) confirmed the green shoot of recovery in attendance.

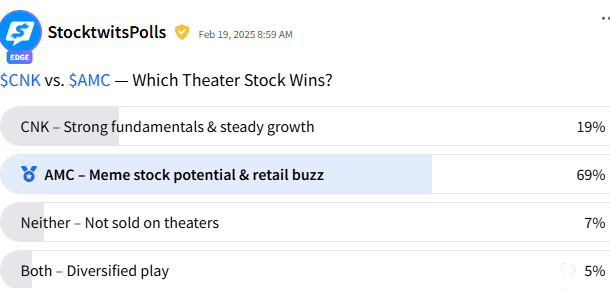

As fundamentals improved from the post-COVID-19 weakness, we asked Stocktwits users regarding their take on which of these two stocks would emerge as winners.

The poll found that 69% of the respondents picked AMC as the likely winner, and a far less 16% sided with Cinemark.

While 7% preferred neither due to the negative view on theater stocks per se, 5% said they preferred both due the diversification they offer.

AMC Vs. CNK: Stock Performance

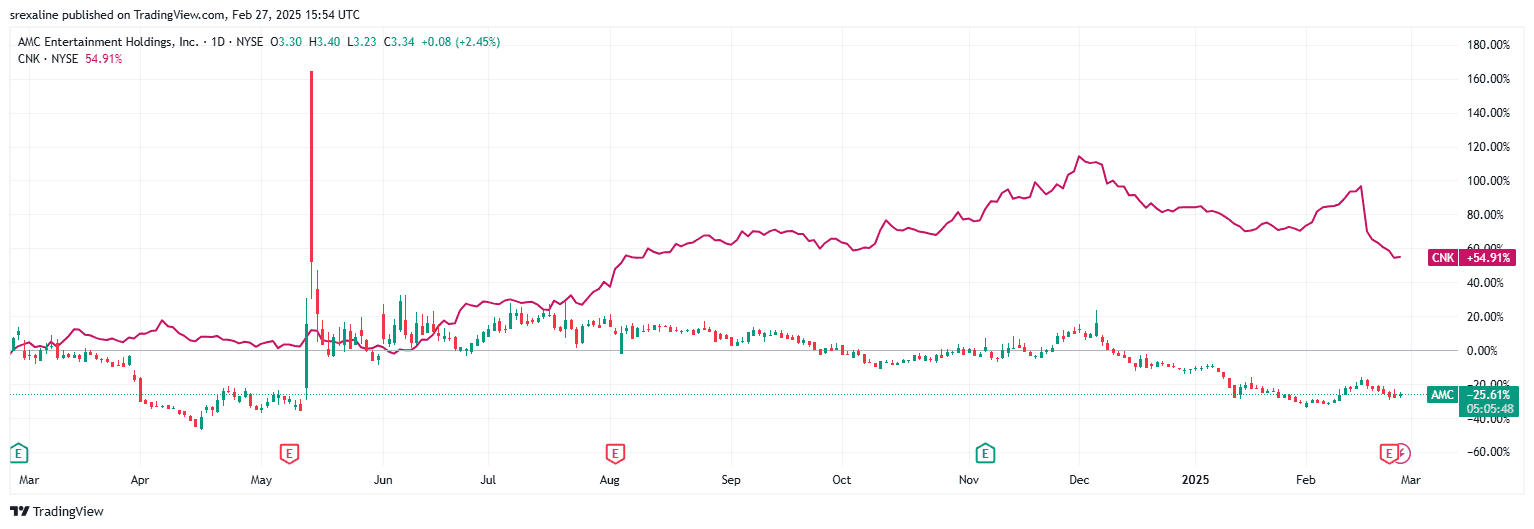

A comparison of one-year stock price performances shows that Cinemark is a clear winner. But for a sharp spike in May 2024, fueled by the reappearance of Keith Gill, aka Roaring Kitty - the retail investor behind the meme mania of 2021, AMC stock has broadly exhibited lackluster performance.

On the other hand, Cinemark stock has fared relatively better.

AMC stock has lost 18% year-to-date (YTD), while Cinemark is down a more modest 16%.

AMC Vs. Cinemark: How They Fared In Q4

AMC and Cinemark reported record revenues for the fourth quarter, fueled by moviegoers’ return to theaters in droves.

AMC’s revenue climbed over 18% YoY to $1.31 billion, exceeding the consensus estimate, and the net loss narrowed to $135.6 million from $182 million.

It generated over $200 million of cash from operating activities and approximately $114 million in free cash flow, the highest quarterly cash flow post-pandemic.

Investment bank Roth MKM said AMC is moving in the right direction, TheFly reported. However, the firm believes the company needs to do more financial engineering. Due to a healthy box office recovery, it expects further improvements in the coming two years.

Roth MKM sees AMC’s free cash flow continuing to remain negative in 2025, potentially necessitating additional equity raises.

Cinemark’s report released last week showed that the company reversed to a profit in the fourth quarter, but the earnings per share (EPS) missed the consensus estimate. Revenue climbed 27.5% year over year (YoY) to $814.3 million.

Sean Gamble, the CEO of the Plano, Texas-based theater chain, attributed the strong topline performance to better-than-expected industry performance.

Cinemark also reinstated its annual cash dividend, which it suspended in 2020.

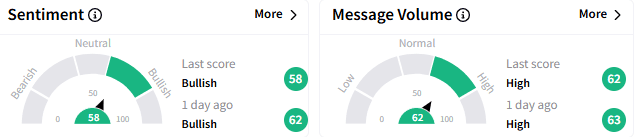

The optimism toward AMC is due to its meme stock potential and the retail buzz. Sentiment toward AMC stock among retail users of Stocktwits remains ‘bullish,’ with the positive mood accompanied by a ‘high’ message volume.

A retailer predicted that next month would be great for the stock.

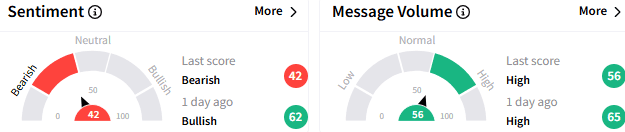

On the other hand, Cinemark evinced ‘bearish’ sentiment from among retailers.

That said, those users who backed Cinemark in the Stocktwits poll believe that the company has strong fundamentals and is on track to see steady growth.

AMC last traded up 1.07% at $3.295, while Cinemark dipped 0.73% at $25.77,

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2071907975_jpg_85e059f13e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219301415_jpg_7634ca599c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2236469013_jpg_0a72164947.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)