Advertisement|Remove ads.

Warner Bros Discovery Stock Rallies As Positive Streaming Business Outlook Overrides Q4 Miss: Retail Stays Bullish

Warner Bros. Discovery, Inc. (WBD) shares rallied early Thursday after the media and entertainment company issued upbeat commentary about its streaming business, comprising Max and Discovery+ services.

However, the company’s fourth-quarter results trailed expectations amid weakness in the U.S. traditional cable and satellite television service business.

The New York-based company’s loss per share widened to $0.20 from $0.16 reported for the year-ago quarter. It also missed the Yahoo Finance-compiled consensus of $0.03 per share earnings.

Revenue fell 2% year over year (YoY) to $10.03 billion versus the $10.16-billion consensus estimate.

Among the segments, distribution revenue was flat YoY at $4.92 billion, with global direct-to-consumer (DTC) revenue growth helping to partially offset the continued decline in domestic linear pay TV subscriber business.

Content revenue fell 2% to $2.91 billion, while advertising revenue declined by 12%. The growth in DTC ad-lite subscribers was more than offset by domestic linear audience declines and the continuing softness in the domestic linear advertising market.

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) climbed 10% to $2.72 billion.

Warner Bros. ended the quarter with 116.9 million DTC subscribers, a 6.3-million increase from the third quarter.

Looking ahead, the company expects the strong DTC subscriber growth to continue throughout 2025, with a clear path to reach at least 150 million global subscribers by the end of 2026.

The company also expects a healthy improvement in its Studio segment’s EBITDA results in 2025.

However, overlapping costs of newly acquired sports rights and the remaining portion of its current National Basketball Association (NBA) deal, which ends in the first half of 2025, will push up sports rights costs and weigh down on 2025 adjusted EBITDA, it added.

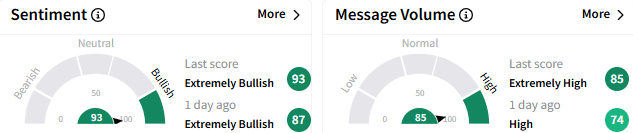

On Stocktwits, retail sentiment was ‘extremely bullish’ (93/100), and message volume remained brisk at an ‘extremely high’ level.

A watcher said Warner Bros. stock is grossly undervalued.

Another user pointed to the $10 billion cash pile.

Warner Bros. stock climbed 7% to $11.23 in early trading. The stock is down less than a percent year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)