Advertisement|Remove ads.

AMD Plunges Toward 2-Year Lows Despite Earnings Beat As Outlook Disappoints: Retail Calls It An Overreaction

Advanced Micro Devices (AMD) shares plunged nearly 10% in pre-market trading on Wednesday, putting the stock on track to hit its lowest level in over two years.

The sharp decline follows the company’s fourth-quarter earnings report, which exceeded analyst expectations but was overshadowed by a cautious outlook for 2025 that disappointed Wall Street.

Citi downgraded the stock to ‘Neutral’ from ‘Buy,’ slashing its price target by $65 to $110.

Bank of America lowered its price target on AMD to $135 from $155 but maintained a ‘Neutral’ rating, and Morgan Stanley cut its price target to $137 from $147 with an ‘Equal Weight’ rating on the stock.

On Stocktwits, AMD was among the top trending tickers in the early morning trade.

AMD reported earnings of $1.09 per share, slightly above the consensus estimate of $1.08, according to Stocktwits data.

Revenue came in at $7.66 billion, surpassing Wall Street forecasts of $7.53 billion and marking a 24% year-over-year increase.

AMD projected revenue between $6.8 billion and $7.4 billion for the current quarter, compared to analysts’ average expectation of $7.04 billion, as per Koyfin.

While the company expressed optimism about 2025, forecasting “strong double-digit percentage revenue and EPS growth year-over-year,” its outlook for the data center segment fell short of investor expectations.

CEO Lisa Su noted on the earnings call that data center revenue is expected to grow at a "strong" double-digit rate, with the second half of the year outperforming the first.

However, in contrast to Nvidia’s rapid growth—with sales doubling annually in recent years—AMD's projections seemed underwhelming to Wall Street analysts.

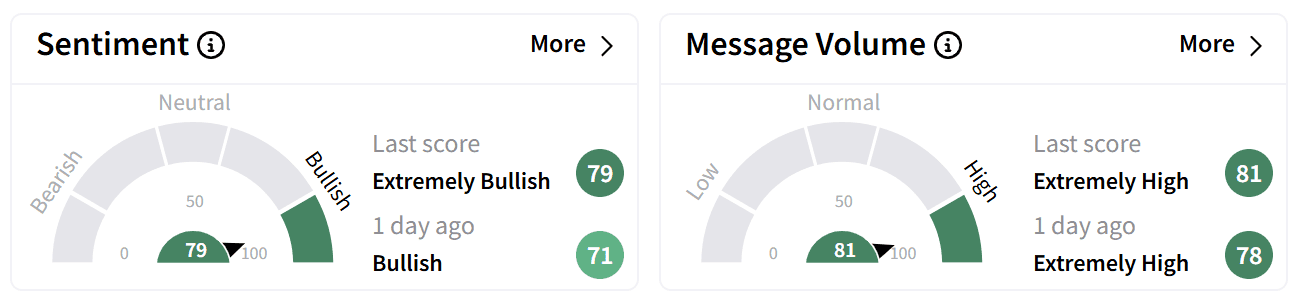

However, on Stocktwits, retail sentiment improved to ‘extremely bullish’ from ‘bullish’ a day ago, with chatter remaining at ‘extremely high’ levels in pre-market trade on Wednesday.

One user forecast that AMD’s stock price would hit $125 by the end of the week.

Another was surprised by the market’s overreaction to an otherwise ‘solid’ quarter.

AMD’s stock has been down over 33% over the last year and has dipped by 15% over the last three months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Qualcomm Edges Higher Ahead Of Earnings, But Retail’s Feeling Uneasy

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)