Advertisement|Remove ads.

Qualcomm Edges Higher Ahead Of Earnings, But Retail’s Feeling Uneasy

Qualcomm Inc. (QCOM) stock rose 1.3% in morning trading on Tuesday ahead of its first-quarter earnings, scheduled for release after the market closes on Wednesday.

Analysts expect the company to report earnings of $2.97 per share, according to Koyfin.

Revenue is expected to hit $10.9 million, a jump of 9.9% over the same quarter last year.

The company’s gross profit is forecasted to reach $6.1 billion, while net income is expected to hit $3.3 billion.

Bernstein reiterated its ‘Outperform’ rating on the stock with a price target of $215 ahead of the earnings, according to a report by Investing.com.

The analyst expects Qualcomm to benefit from the smartphone sector’s strong performance, which experienced approximately 6% growth year-over-year in 2024, positively impacting Qualcomm due to its focus on high-end smartphone models.

While potential challenges from Apple (AAPL) are acknowledged, they are already factored into market expectations, according to Bernstein.

Apple plans to phase out Qualcomm modems completely by 2027, starting with its first in-house modem debuting in the iPhone SE. Qualcomm currently supplies 5G modem chips for iPhones under a contract that extends through 2026.

Qualcomm currently supplies 5G modem chips for iPhones, though its contract only extends till 2026

Bernstein also highlighted that concerns over Huawei's licensing renewal have minimal impact, as Huawei now represents a minor portion of Qualcomm's business.

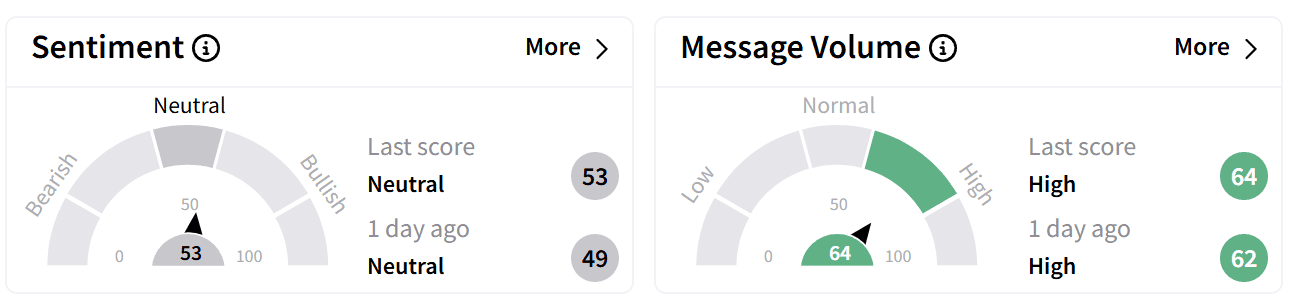

On Stocktwits, retail sentiment remained ‘neutral’ accompanied by ‘high’ levels of chatter.

The more optimistic investors expect the stock’s price to rise after the earnings tomorrow, while others were hoping that the earnings will provide an update on whether Qualcomm may have another go at acquiring Intel (INTC).

Wall Street maintains a bullish stance on Qualcomm, with an average price target of $202—an upside of over 17% from current levels.

Out of 39 analysts covering the stock, 21 rate it as a ‘Buy’-equivalent, while 17 recommend ‘Hold’.

Qualcomm’s stock has gained over 21% in the last year with gains of 11% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: AMD Stock Swings Wildly Pre-Market On Price Target Cut Ahead Of Q4 Earnings: Retail Divided

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)