Advertisement|Remove ads.

AMD Stock Hits Over 1-Year Low As Analysts Cite PC Market Challenges, Nvidia Threat Ahead of Q4 Earnings: Retail Sentiment Sours

Advanced Micro Devices (AMD) stock fell over 1.5% in Tuesday morning trade, hitting its lowest level in more than a year after Melius Research downgraded the shares. The brokerage flagged concerns over the company’s long-term outlook in the x86 server and PC markets amid growing competition from other chip makers like Nvidia (NVDA),

The 52-week low comes after the stock lost 6.4% during a wider tech sector sell-off on Monday, triggered by reports of Chinese AI startup DeepSeek unveiling a competitive AI model, which impacted major technology stocks.

The volatility comes ahead of AMD’s fourth-quarter earnings report, scheduled for after market close.

Analysts expect the company to report earnings per share (EPS) of $1.09 on $7.5 billion in revenue, according to Koyfin data.

Ahead of the earnings, Melius Research downgraded AMD (AMD) to ‘Hold’ from ‘Buy’ with a price target of $129, down from $160.

The brokerage said that the downgrade is not due to DeepSeek's impact but concerns that Nvidia’s growing presence in both the PC and server markets—driven by its Arm-based CPUs—could impact AMD’s x86 market share.

In a note to investors reported by The Fly, Melius highlighted that custom CPUs, including those from Nvidia, pose a long-term risk to AMD’s dominance in these sectors, even though AMD’s current server chip, Turin, has performed well.

Meanwhile, Wedbush also reduced its price target on AMD to $150 from $200 while maintaining an ‘Outperform’ rating.

The firm moderated its expectations for AMD’s artificial intelligence GPU sales in 2025 but noted that these revisions are likely already factored into buy-side expectations.

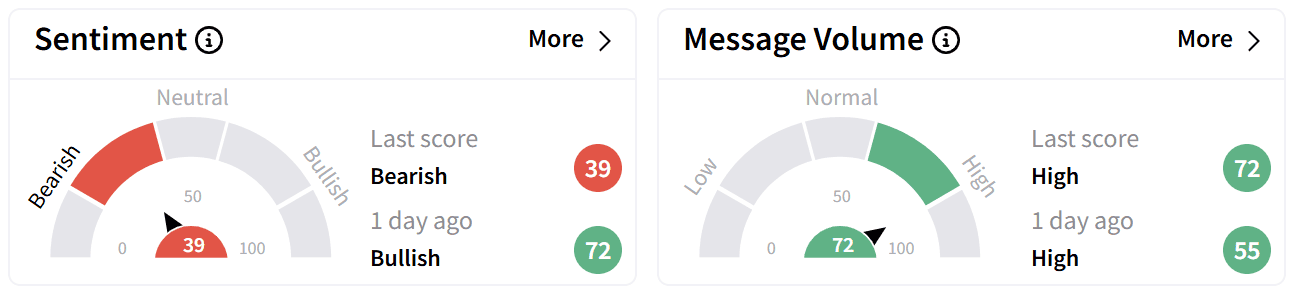

On Stocktwits, retail sentiment around AMD turned ‘bearish’ from ‘bullish’ a day ago, while message volumes remained at ‘high’ levels.

Retail investors on the platform pointed to the company’s upcoming earnings as a key factor for future stock performance.

Cathie Wood’s Ark Invest added 42,554 AMD shares to its portfolio on Monday, worth approximately $4.89 million, even as the stock slid.

AMD’s stock is down 36% over the last year, with losses of 6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)