Advertisement|Remove ads.

Ameresco Stock Jumps After Beating Q1 Revenue Estimates, Retail Welcomes Federal Contract Resumptions

Ameresco (AMRC) stock jumped 18.7% in extended trading on Monday after the energy services firm topped Wall Street estimates for first-quarter revenue.

The company reported total revenue of $352.8 million for the quarter ended March 31, while analysts expected it to post $306.6 million in revenue, according to Koyfin data.

It also reported an adjusted loss of $0.11 per share, compared to Wall Street’s expectations of a loss of $0.25 per share.

The company saw strong growth in the Projects and Energy Assets segment revenue due to a strong backlog.

During the quarter, the company added over $367 million to award backlog while converting $334 million of awards into contracts.

At the end of the quarter, Ameresco’s total project backlog stood at $4.9 billion, a 22% increase compared to a year earlier.

“We are pleased to report that we have not encountered any additional cancellations or delays in our Federal contracts, and those that we highlighted the previous quarter as being delayed or cancelled have now been ‘unpaused’ or modified and are progressing,” CEO George Sakellaris said.

The company reiterated its 2025 forecasts for revenue and adjusted earnings before interest, taxes, depreciation, and amortization.

The Framingham, Massachusetts-based company said it has a limited near-term exposure to tariffs as it has already acquired much of the equipment for ongoing projects.

“Beyond 2025, we will try to mitigate the effect of price increases during contract negotiations and repricing where possible,” Sakellaris said.

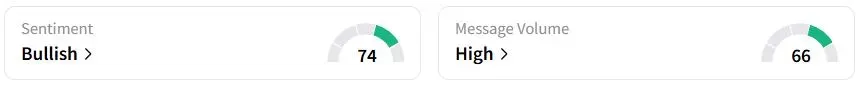

Retail sentiment on Stocktwits was in the ‘bullish’ (74/100) territory, while retail chatter was ‘high.’

One retail trader was pleased that the company is executing most of the federal contracts that were canceled or paused.

Ameresco stock has fallen 51.4% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)