Advertisement|Remove ads.

AmEx Stock Falls After Analyst Downgrade: Is Retail Confidence Shaken?

Shares of American Express (AXP) fell over 3% on Wednesday after a key analyst downgrade raised concerns about the company's future growth. This has sent mixed signals to retail investors, with some remaining optimistic and others expressing caution.

AXP has reportedly been a stand-out performer in the Dow Jones Industrial Average this year, surging over 30%. This success is attributed to its loyal, high-spending customer base and recent efforts to attract younger generations.

However, Bank of America Global Research analyst Mihir Bhatia has downgraded Amex from ‘buy’ to ‘neutral’ due to concerns about its valuation and ability to maintain its high growth trajectory in the current economic climate.

Bhatia cited several factors:

- AXP's stock price is near 10-year highs and trades at a premium compared to competitors.

- Uncertainties about future consumer spending, particularly in travel and leisure, a key area for Amex.

- Slower-than-expected growth in billed business during Q2, falling short of analyst estimates.

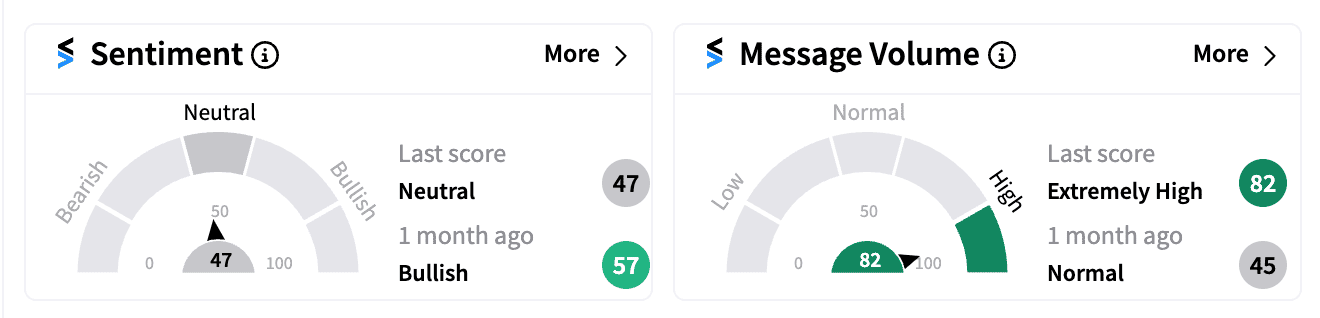

On Stocktwits, retail sentiment for AXP has shifted from ‘bullish’ – from the time it reported latest earnings – to ‘neutral’ (47/100) following the news. Amid message volume spiking to ‘extremely high’, opinions diverged.

Some investors remain optimistic, pointing to signs of a rebound in consumer spending and the success of recent earnings reports from major retailers like Walmart and Target.

Others are more cautious, citing technical analysis suggesting potential for further declines.

According to the BofA analyst, there’s a possibility that other credit card companies such as Synchrony Financial (SYF) and Capital One Financial Corp (COF) might perform better in a ‘soft landing’ economic scenario.

For now, retail investors are in agreement with him.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_161161978_jpg_1bfd59def9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Astra_Zeneca_jpg_a49cc22562.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2020/11/enforcementdirectorate1.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/07/28-exp-15-interior-2025-07-557b59240aa96521ceb4d2ec7b6d534c.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_bitfarms_logo_resized_f65def1bbc.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)