Advertisement|Remove ads.

Anant Raj Could Offer Over 50% Upside If This Key Level Is Breached: SEBI RA Krishna Pathak

Anant Raj is showing signs of consolidation ahead of a potential uptrend, according to Krishna Pathak, a SEBI-registered analyst.

The stock is currently trading near its key 9-week exponential moving average (EMA) support at around ₹550, showing signs of consolidation, Pathak noted. With the stock consolidating in a well-defined range, a breakout above the immediate resistance zone of ₹570 could trigger the next phase of upward momentum.

At its current market price, Anant Raj offers an attractive setup for medium-term investors, the analyst said.

Anant Raj stock has strong support around ₹400, while the accumulation zone between ₹470 and ₹490 has historically attracted demand, making it a favorable entry point.

Technically, the chart reflects consolidation with a bullish undertone. A sustained breakout above ₹570 could potentially drive the stock towards ₹650, with further upside targets at ₹715 and ₹770. Volume confirmation on the breakout would strengthen the bullish case.

The higher end of the target represents a 40% premium to the current stock price of ₹550.

However, the Stochastic relative strength index (RSI) is hovering near the overbought zone, suggesting that a short-term consolidation is possible. A breakdown below ₹400 would invalidate the bullish setup and may lead to a deeper correction, he added.

The real estate developer has been in the spotlight recently. According to reports, Anant Raj plans to invest $2.1 billion to build two new data centers in Haryana. Last year, the company partnered with French IT firm Orange Business to offer cloud services alongside its data center infrastructure.

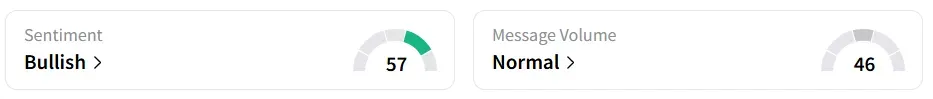

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day ago.

The stock has shed nearly 36% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)