Advertisement|Remove ads.

Anavex Retail Traders See Silver Lining In EMA Committee Postpones Alzheimer’s Drug Verdict: Delay 'Actually A Positive Sign'

- The CHMP issued a negative trend vote but postponed its final decision to December.

- Retail traders were divided, citing leadership concerns, cash pressure and subgroup data.

- Some pointed to re-examination plans and potential FDA activity over the coming months.

Anavex Life Sciences drew a wave of retail discussion over the weekend after the European Medicines Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP) delayed its verdict on the biotech’s Alzheimer’s drug Blarcamesine until December.

Anavex shares fell 36% on Friday, marking their worst single-day drop in over eight years, after the committee published a list of ten medicines it backed at its latest meeting, and Blarcamesine was not among them. Anavex later confirmed it had received a negative trend vote following its oral explanation and noted that a formal opinion is expected in December. The company also stated that it plans to request a re-examination once the opinion is issued. The drug was not listed among withdrawn applications, leaving the procedure formally open heading into the next meeting.

Retail Reads Delay As Potentially Encouraging

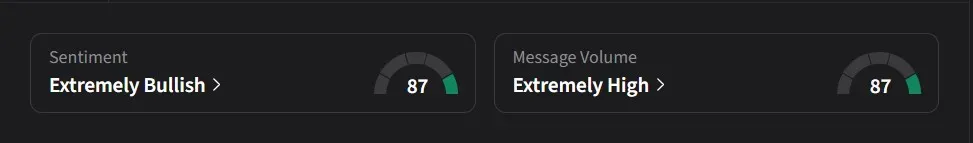

On Stocktwits, retail sentiment for Anavex was ‘extremely bullish’ amid ‘extremely high’ message volume.

Some retail traders pointed to the committee’s timing as noteworthy. One user said the delay until December was “actually a positive sign,” arguing that drugs facing immediate rejection typically receive a negative opinion in the same meeting. The user suggested the additional time may reflect internal scientific disagreement and the need to examine wild-type and biomarker data more closely.

Another user focused on potential upcoming regulatory activity, saying, “Odds of finding out about an FDA application in the next 3 months is in the very likely. That will give credibility to the appeal. Should make things interesting.”

Concerns About Leadership

Other traders focused on the company’s strategy as Anavex navigates the re-examination path. One user argued that the company needed “a new leadership, a good communicator… someone credible and recognize in the financial community,”

The same user said Anavex faces “challenging time, cash is limited, sharks are all around,” and outlined potential approaches, including continuing with the re-examination while advancing 3-71 for schizophrenia. They added that if the EMA ultimately rejects the re-examination, the company could shift its focus away from Alzheimer’s and prioritize the schizophrenia program. In their view, pursuing another Alzheimer’s Phase 3 trial alone would raise the possibility of a reverse split.

Debate Over CHMP Language

Some users examined the CHMP’s communication more closely. One trader described the negative-trend wording as unusually vague, noting that the range of committee support or opposition was unclear. They said the statement’s ambiguity left “all options open” and likened the process to “Cold War”-style parsing of official language.

The same user argued that the drug’s open-label extension results had demonstrated what they saw as strong scientific signals, saying the “odds ratio went into double digits territory” and suggesting that larger pharmaceutical companies would be aware of those outcomes.

Focus On Precision-Medicine Subgroup

Another user emphasized the potential role of precision medicine in the review, saying approval becomes more plausible if the SIGMAR1 wild-type subgroup showed no disease progression, consistent clinical benefit, biomarker alignment and a mechanistically predictable response. They argued that these factors could give the EMA a basis for conditional approval.

Anavex’s stock has declined 66% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)