Advertisement|Remove ads.

APA Stock Slips After Q4 Profit Miss, Retail Sentiment Mixed

APA Corp (APA) stock edged lower in after-hours trading on Wednesday after the company’s fourth-quarter earnings missed Wall Street’s estimates.

The oil and gas producer reported adjusted earnings of $0.79 per share for the quarter ended Dec. 31, while analysts, on average, expected the company to report $0.95 per share in earnings, according to FinChat data.

The company reported quarterly net revenue of $2.50 billion, which topped Wall Street’s estimated $2.31 billion.

Its adjusted production rose 23% to 418,347 barrels of oil equivalent per day (boe/d), aided by a 37% rise in output from its U.S. assets.

APA completed its $4.5 billion acquisition of smaller peer Callon Petroleum last year to boost its production from the Permian Basin.

The company posted a net income of $354 million, or $0.96 per share, compared with $1.77 billion, or $5.78 per share, in the year-ago quarter.

APA said average oil prices across its business fell to $72.42 per barrel, compared with $81.36 per barrel in the year-ago quarter. The decline in oil prices was partially offset by an uptick in natural gas liquids prices.

The Houston-based company forecasted 2025 oil and gas capital investments between $2.5 and $2.6 billion. This figure includes $100 million for exploration activities, primarily in Alaska, and $200 million for progressing the GranMorgu project in Suriname.

APA and its partner TotalEnergies expect to produce 220,000 barrels per day of oil from the GranMorgu project, which is scheduled to come online in 2028.

APA also projected adjusted production to rise to 396,000 boe/d this year, with natural gas production benefiting from no 'price-related curtailments.'

“We expect to run eight rigs in the Permian and 12 rigs in Egypt, leading to a slight increase year-over-year in Permian and adjusted Egypt volumes,” said CEO John Christmann.

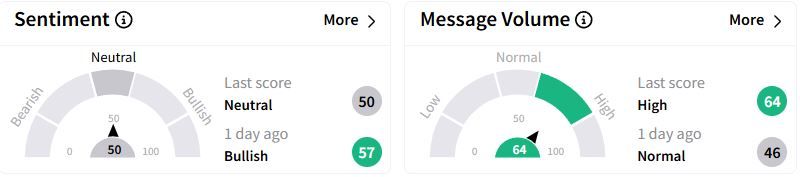

Retail sentiment on Stocktwits moved to ‘neutral’ (50/100) territory from ‘bullish’(57/100) a day ago, while retail chatter rose to ‘high.'

Over the past year, APA stock has fallen 26.6%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Deere_resized_a913c16f0a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_b2gold_jpg_2d344842dd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_whitehouse_OG_jpg_2cc16854dc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)