Advertisement|Remove ads.

APL Apollo Delivers Mixed Q1 Earnings; SEBI RAs Divided Over Near-term Growth

Shares of APL Apollo Tubes were down over 5% on Friday after posting mixed quarterly earnings.

Earnings Review

While sales volume increased 10% year-over-year, it declined 7% on a sequential (QoQ) basis. Revenue rose 15% YoY to ₹5,402 crore, while profit after tax grew 7% YoY to ₹203 crore, despite a 10% QoQ dip due to seasonality and operational bottlenecks. Margins held steady at 7.6%. The company’s net cash position also declined to ₹2.1 billion from ₹3.1 billion in Q4FY25.

Looking ahead, the company has outlined a clear long-term growth strategy. It plans to ramp up annual steel tube production capacity from 4.5 million tons to 6.8 million tons by FY28. To support this, a ₹1,500 crore capex has been earmarked over the next three years for brownfield and greenfield expansion.

Technical Analysis

APL Apollo Tubes stock breached the 200-day exponential moving average (EMA) and is hovering near the 50% Fibonacci retracement level, noted SEBI-registered analyst Mayank Singh Chandel.

While some support zones exist nearby, there’s currently no strong technical signal for a reversal, Chandel added. The price action reflects caution, and unless a decisive bounce emerges, the chart does not currently offer a buy setup.

Although short-term financial pressures are visible, long-term investors should monitor how the capital expenditure plan impacts earnings, Chandel recommended.

On the other hand, SEBI analyst Saurabh Sahu sees a bullish flag pattern forming near a strong support zone at ₹1,650 - ₹1,660.

APL Apollo Tubes is showing signs of a technical turnaround after a recent pullback from its June high of ₹1,950, Sahu said. The stock remains in a medium-term uptrend.

The relative strength index (RSI) appears to be cooling off, and price action near this zone suggests a potential reversal is taking shape.

Key support levels for the stock are at ₹1,650 and ₹1,580, while resistance lies between ₹1,750 and ₹1,825.

Sahu recommends buying on dips near ₹1,650, placing a stop-loss below ₹1,580. The upside target over the next couple of months is expected to be in the ₹1,825 - ₹1,950 range.

And Financial Independence is positive on APL Apollo Tubes after they reported strong volume-led growth with margin improvement. They added that the expansion in value-added segments and continued infra demand strengthen the medium-term outlook.

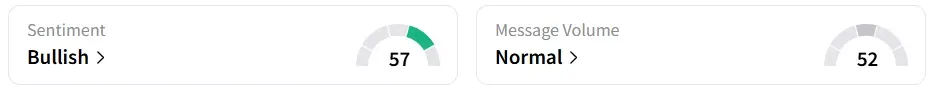

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ the day before.

Year-to-date, the stock has seen a marginal growth of 1.7%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)