Advertisement|Remove ads.

Apple's Q2 Beat Baked In, But Analysts Warn Of Tough Second Half As Trump Tariff Bites: Retail Stays Hopeful

Apple, Inc. (AAPL), one of the hardware names expected to be most impacted by the Trump administration's China tariffs, will report its financial results for the second quarter of the fiscal year 2025 after the market closes on Thursday.

By late Wednesday, the stock was among the top 30 most active tickers on Stocktwits.

Expectations By Numbers

According to the Finchat-compiled consensus estimate, analysts expect Apple to report second-quarter earnings per share (EPS) of $1.62. This marks an increase from the year-ago quarter's $1.53 but a decline from the $2.40 reported for the seasonally strong December quarter.

Revenue is expected to rise 4.5% year-over-year (YoY) but fall 24% sequentially to $94.42 billion.

Apple's guidance, issued in late January, called for mid-single-digit YoY revenue growth.

The company also expects to report a gross margin of 46.5% to 47.5%.

The second-quarter consensus estimates for product categories (made available through Morgan Stanley) are as follows:

- iPhone: $45.62 billion (based on 50,248 units and $864 average selling price (ASP)

- iPad: $6.23 billion

- Mac: $7.78 billion

- Wearables: $7.98 billion

- Services: $26.71 billion

The deterioration of trade relations between the U.S. and China, Apple's main supply base, has stirred concerns about price hikes for its flagship product, the iPhone, which in turn will likely hurt demand.

Reports have suggested that Apple is considering shifting the manufacturing of all its U.S.-bound iPhones to India.

Sell-Side Take

The results of Morgan Stanley's March 2025 AlphaWise survey showed positive trends. The number of U.S. iPhone owners with Apple Intelligence willing to pay up to $9.11 monthly for artificial intelligence (AI) access increased by 11% from September 2024.

Over half of U.S. iPhone owners reported being highly likely to upgrade their device within the next 12 months, marking an all-time high.

Morgan Stanley analyst Erik Woodring expected the March quarter results to exceed the consensus estimates, underpinned by strong product pull-forward, a weaker dollar, and 12% Services revenue growth.

The analyst also expects the company to announce a 4% dividend increase, and a $110 billion additional buyback authorization, similar to the actions taken last April.

Morgan Stanley does not see the quarterly print as a key catalyst, given tariffs, China, AI, iPhone, and the regulatory environment remain key unknowns.

Woodring on Tuesday upped the price target for Apple stock to $235 from $220.

Among other analysts, Raymond James analysts reduced Apple's stock price target to $230 from $250 but maintained an 'Outperform' rating, attributing the action to tariff headwinds. The firm recognized the need for iPhone price hikes in the U.S., potentially leading to demand destruction in the second half.

Barclays also reduced the stock price target to $173 from $197 despite expecting a March quarter beat. The firm predicted a worse second-half outlook due to pull-in reversal and demand slowdown induced by tariffs and higher selling prices.

The consensus estimate for the third quarter is $1.47 EPS and $88.91 billion in revenue.

On Wednesday, Loop Capital lowered the price target for the stock to $215 from $230, citing amended estimates based on fresh iPhone build updates from the firm's supply chain study and the tariff dynamics.

Retail Upbeat

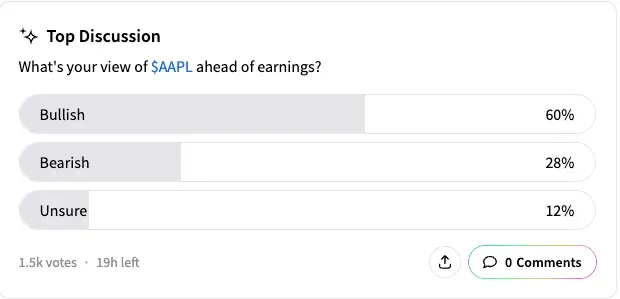

A Stocktwits poll that sought views from users about Apple stock ahead of the earnings found that under two-thirds of the respondents (60%) remained bullish ahead of the quarterly results.

About one-fourth (28%) were bearish, and the remaining 12% remained unsure.

Apple shares have shed 15% for the year-to-date period and traded well off their all-time high of $260.10 on Dec. 26.

The Koyfin-compiled consensus analysts' price target for Apple stock is $235.05, implying that the stock traded at an 11% discount.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Solana_722b6a3879.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_X_Elon_Musk_274c6a8683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_o_leary_OG_jpg_2789641a97.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260269284_jpg_cf42b9b8c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Patrick_Witt_d5f3eaa4da.webp)