Advertisement|Remove ads.

Apple Credit Card To Be Taken Over By JPMorgan Chase: Report

- Goldman Sachs will offload about $20 million of outstanding credit card balances at a discount of over $1 billion, WSJ said.

- Both existing and new Apple customers will get new JPMorgan-issued cards, according to the report.

- The bank will also launch a new Apple savings account under the deal.

Apple Inc.’s (AAPL) credit card program will reportedly shift to JPMorgan Chase & Co. (JPM) from Goldman Sachs Group, Inc. (GS).

According to a report from the Wall Street Journal, the bank is set to become the tech giant’s new issuer in a deal that has been under negotiation for over a year.

Goldman Sachs will offload about $20 million of outstanding credit card balances at a discount of over $1 billion, WSJ said, citing people familiar with the matter.

The deal is expected to be announced soon as long as there are no other obstacles, the report said.

Deal Contours

Under the deal, JPMorgan will get access to Apple’s loyal customer base that it can sell more financial products to, while the tech company will benefit from the former’s help to sell and finance more gadgets, the report noted.

Both existing and new Apple customers will get new JPMorgan-issued cards, according to the people who spoke with The Wall Street Journal. However, the shift from Goldman Sachs to JPMorgan would take time, the report noted.

The bank will also launch a new Apple savings account under the deal, as per the report. Existing customers who already have an Apple savings account at Goldman Sachs will be given the option to stay or switch to JPMorgan, the report said.

While most such deals sell at a premium, the discount in this case comes from high exposure to subprime borrowers and higher-than-average delinquency rate. Apple and Goldman Sachs got together in 2019 to launch the credit card but losses and regulatory probes began weighing down on the collaboration.

As per the newspaper, Goldman Sachs has been trying to pass on Apple to a new issuer for more than two years.

How Did Stocktwits Users React?

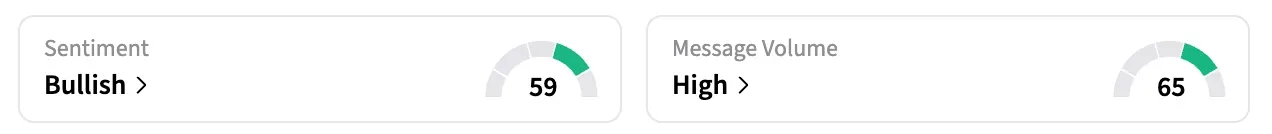

On Stocktwits, retail sentiment around AAPL shares jumped to ‘bullish’ from ‘neutral’ territory over the last 24 hours amid ‘high’ message volumes. The stock was also among the most trending tickers on the platform at the time of writing.

Meanwhile, retail sentiment around JPM shares stayed at ‘bearish’ territory amid ‘normal’ message volumes while GS shares were in ‘neutral’ territory amid ‘high’ message volumes in the same period.

AAPL shares climbed 0.04% in Wednesday’s after-market hours and have gained 7.5% in the past year.

Shares of JPM climbed over 34% while GS shares increased over 62% in the same period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also Read: Nuvve Stock In Focus As It Soars Over 78% — What Are Retail Investors Saying?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1230125578_jpg_85f30da0d4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1233729079_jpg_0ced7540cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Norwegian_Cruise_jpg_ba826c7555.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_stock_jpg_1a4860daf4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)