Advertisement|Remove ads.

Retail Investors Reconsider Apple Ahead Of Earnings Even As Wall Street Hands Out Price-Target Hikes

Apple Inc.'s stock (AAPL) has taken a hit after getting caught in the crossfire of a broader tech market downturn sparked by Tesla and Alphabet’s disappointing results. The decline over the past week has knocked retail sentiment from its previously bullish zone, but current readings suggest investors are not throwing in the towel.

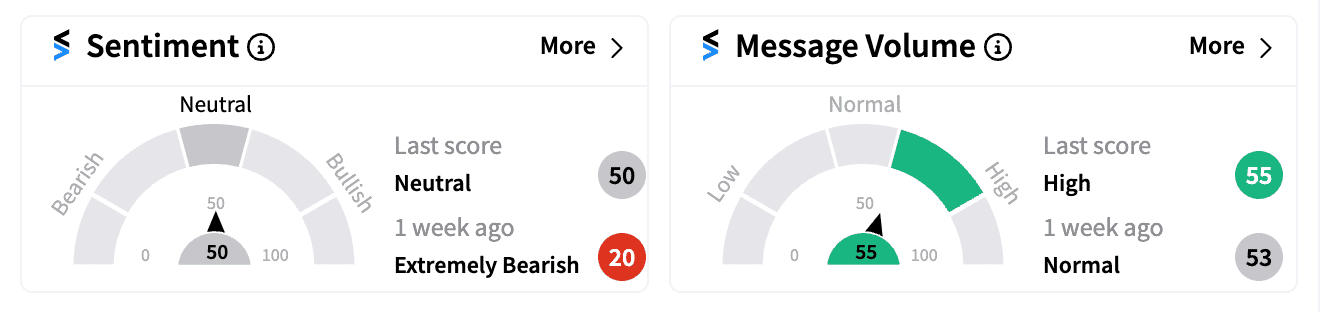

Stocktwits data reveals a balanced outlook on Apple, with a sentiment score of 50/100 on Thursday afternoon. Discussion volume and the number of users’ participating in the conversation remains high.

As the company gears up for its third-quarter earnings report next month, analysts anticipate EPS of $1.34; Apple has surpassed this metric’s estimates for the past four quarters straight. However, the broader market climate and certain headwinds like a weak iPhone upgrade cycle could play spoilsport.

Wall Street analysts have offered a mixed bag of opinions. While Baird's bullish stance and increased price target to $240 injected some optimism, other analysts, such as those at Barclays and JPMorgan, have maintained a more cautious outlook even though they raised price targets.

Adding to the complexity, Apple is grappling with external challenges. A shift in investor appetite towards smaller companies and the company's declining market share in China, where Huawei is making significant strides, pose potential risks.

Furthermore, renowned Apple analyst Ming-Chi Kuo's tempered expectations for the upcoming iPhone 16 series, based on supplier data, have cast doubt on the anticipated sales surge.

With earnings on the horizon, Apple's ability to navigate these challenges and deliver strong financial results will be crucial in determining the stock's future trajectory.

Apple’s retail investors have not lost faith completely, but remain cautious about making any big bets in either direction until more information is available.

“Never doubt apple,” said a user going by the handle anon_trader69.

“Their phones are boring and have been mostly the same for over a decade. Samsung is far better in all aspect. I’ve had an iphone forever and get my flip6 this weekend. Bye bye Apple,” read a post from a bearish watcher.

The numbers will speak for themselves when Apple, the second-most watched symbol on Stocktwits with over 930,000 followers, reports Q3 results next Thursday, August 1st, after the closing bell.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256975450_jpg_6e75ded706.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1368998806_1_jpg_3647893e85.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2169625480_jpg_988055282a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257634592_jpg_fbf5a8988d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wendy_s_resized_jpg_9b298d0aee.webp)