Advertisement|Remove ads.

Apple’s AI Potential Spurs Fresh Price Target Hikes From Analysts

- Dan Ives, managing director at Wedbush Securities, lifted his price target on Apple to $350 from $320.

- Ives estimates an incremental lift of $75 to $100 per share as Apple rolls out new AI-driven features.

- Evercore ISI analyst Amit Daryanani boosted his price target for Apple to $325 from $300.

Wall Street is increasingly convinced that Apple Inc. (AAPL) is nearing a pivotal shift in its artificial intelligence roadmap, setting the stage for a major transformation in the company’s long-term product strategy.

Wedbush Securities and Evercore ISI increased their price targets on the stock, citing Apple’s deeper push into AI as a potential benefit.

Wedbush Raises Expectations

Dan Ives, managing director at Wedbush Securities, lifted his price target on Apple to $350 from $320, citing that the company is finally positioned to take a meaningful step into the broader AI race next year., according to TheFly.

“2026 is going to finally be the year that Apple actually enters the AI Revolution.”

-Dan Ives, Managing Director, Wedbush Securities

He cited healthy demand for the recently launched iPhone 17, especially strong sales momentum in China, and favorable year-end holiday season forecasts.

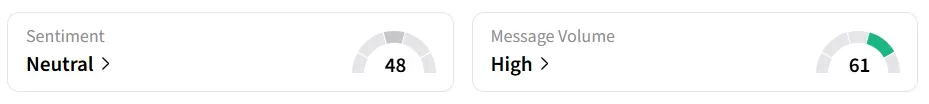

Apple’s stock traded over 0.3% lower on Monday afternoon. On Stocktwits, retail sentiment around the stock changed to ‘neutral’ from ‘bullish’ territory amid ‘high’ message volume levels.

Wedbush projected that Apple’s eventual AI monetization strategy could add significant value to the stock over the next several years, with Ives estimating an incremental lift of $75 to $100 per share as the company rolls out new AI-driven features. The firm expects Tim Cook to remain at the helm through at least 2027 to steer Apple through this transition.

Evercore ISI Highlights Siri Overhaul

Evercore ISI analyst Amit Daryanani boosted his Apple price target to $325 from $300, citing what he describes as a major redesign of Siri powered by Alphabet Inc.'s (GOOG, GOOGL) Gemini model.

The firm anticipates the next-generation assistant will debut in March 2026 ahead of WWDC. Evercore expects the upgrade to mark a meaningful narrative shift for Apple’s AI positioning.

AAPL stock has gained over 10% year-to-date.

Also See: OpenAI Survey Shows Major Productivity Surge Among Customers: How Much Time Did Heavy Users Save?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)