Advertisement|Remove ads.

Apple Supplier Reportedly Sends More India-Made iPhones To US To Mitigate Tariff Impact: Retail Turns Cheery

Apple Inc. (AAPL) is redirecting its iPhone export strategy by leaning heavily on India-based manufacturing, with the majority of devices now being shipped directly to the United States.

A Reuters report stated that between March and May 2025, nearly 97% of iPhones assembled by Apple's primary supplier in India, Foxconn, were shipped to the U.S.

This is a considerable increase from an average of 50% earlier in the year. This shift illustrates Apple’s efforts to shield itself from rising U.S. import tariffs on Chinese-made goods.

This marks a change in the iPhone maker's global distribution model, as Apple attempts to navigate escalating trade tensions between Washington and Beijing.

Foxconn shipped iPhones worth approximately $3.2 billion from India over the three months, with nearly $1 billion sent out in May alone. That figure marked the second-largest monthly total, just behind March’s peak of $1.3 billion.

The surge corresponds with former President Donald Trump’s proposed 55% tariff on Chinese goods, a key element of a broader trade overhaul still awaiting confirmation.

Unlike China, which is subject to much higher U.S. duties, India faces a relatively moderate 10% import tax when exporting to the U.S.

However, another Reuters report highlighted that Apple appears to be regaining momentum in key global markets, with iPhone sales reaching the top position in China for May and worldwide sales jumping 15% year-over-year during April and May.

According to data compiled by Counterpoint Research, the rebound marks Apple’s strongest two-month stretch since the onset of the COVID-19 pandemic.

Morgan Stanley reports that aggressive promotional activity during China’s 618 Festival is boosting demand for iPhones and iPads, with stronger-than-expected sales likely to lift Apple’s June-quarter performance, as per TheFly.

The firm now anticipates an additional three million iPhone units and 2.5 million more iPads than previously estimated for the quarter, translating to a potential $4 billion revenue increase if other factors remain unchanged.

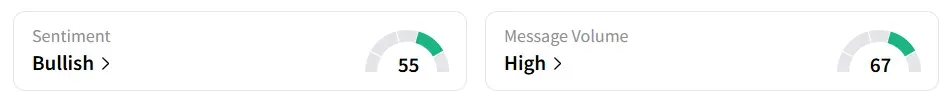

On Stocktwits, retail sentiment around Apple changed to ‘bullish’ from ‘neutral’ the previous day.

Apple stock has lost over 20% year-to-date and 7% in the last 12 months.

Also See: Elon Musk’s xAI Reportedly Snags Backing From Dozens Of PE Investors At Jaw-Dropping $113B Valuation

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)