Advertisement|Remove ads.

Applied Digital Lands Macquarie-Backed Loan Facility To Fund New AI Data Center Projects

- The company is in advanced negotiations with an investment-grade hyperscaler.

- The company plans to use the initial $100 million from the facility to support development at multiple campuses.

- The facility will be executed through Applied Digital’s unit APLD DevCo LLC.

Applied Digital Corp. (APLD) entered into a loan facility with Macquarie Group on Thursday to fund pre-lease development costs for new data centre projects, strengthening its push into AI-optimized infrastructure.

The facility, executed through Applied Digital’s unit APLD DevCo LLC, will provide early-stage capital to support site sourcing, planning, development, and construction of new data center campuses.

Applied Digital is in advanced talks with an investment-grade hyperscaler for multiple campuses, and plans to use the initial $100 million from the facility to support development at those sites.

“This development facility strengthens our ability to move quickly on high-quality sites while maintaining capital flexibility,” said Wes Cummins, Chairman and Chief Executive Officer of Applied Digital.

At the time of writing, the stock traded higher by around 9%. APLD was also among the top-trending tickers on Stocktwits. The stock has been trending down lately, declining in five of the past six sessions. In that period, the stock fell around 32%.

AI Infra Push

Applied Digital, which originally built and operated large U.S. data centers for bitcoin mining, has increasingly shifted toward AI infrastructure this year. In November, the company confirmed that its 100-megawatt Polaris Forge 1 AI Factory Campus in North Dakota began operations.

To fund the development of the campus, the company priced a $2.35 billion private offering of 9.25% senior secured notes due 2030.

The Polaris Forge 1 campus represents the initial delivery under long-term lease agreements tied to a 400-megawatt deployment, generating an estimated $11 billion in lease revenue. In addition, Applied Digital also announced a separate 200-megawatt lease at its Polaris Forge 2 campus, bringing total leased capacity across both North Dakota sites to 600 megawatts.

How Did Stocktwits Users React?

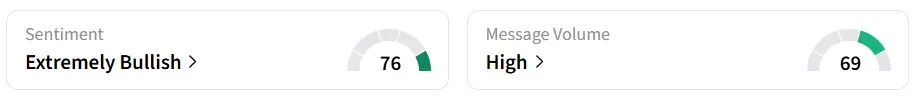

Retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘bullish’ a day earlier, amid ‘high’ message volumes. One user noted that the price action is weak despite the news.

Year-to-date, the stock has surged over 200%.

Read also: Safe Pro Stock Surged Over 15% Today – What Are The Factors In Play?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252871865_jpg_74865c27a7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_QR_OG_jpg_08610d948a.webp)