Advertisement|Remove ads.

Applied Materials Stock Rallies Following An Upgrade From Morgan Stanley: Here’s The New Price Target

Applied Materials Inc. (AMAT) received a bullish endorsement from Morgan Stanley on Monday, as analyst Shane Brett upgraded the semiconductor equipment maker to “Overweight” from “Equal Weight.”

The firm also raised its price target to $209, up from $172, reflecting increased confidence in the company’s exposure to memory and DRAM markets, according to TheFly.

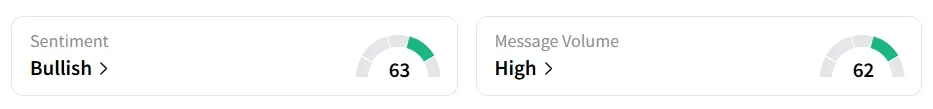

Applied Materials stock traded over 3% higher on Monday mid-morning. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘high’ message volume levels.

The stock saw a 300% increase in user message count over the last week.

Analyst Brett said Morgan Stanley’s updated 2026 outlook for wafer fabrication equipment (WFE) sales now projects a 10% year-over-year growth, double its prior estimate. Much of this growth is tied to the memory segment, where the base-case forecast now nearly matches its previous bullish stance.

Morgan Stanley sees Applied Materials as having the highest leverage to the DRAM greenfield market among peers under its coverage. The firm considers China, ICAPS (IoT, Communications, Automotive, Power, Sensors), and leading-edge logic as largely de-risked at this stage, which further enhances the investment appeal.

According to a CNBC report, Morgan Stanley noted that Applied Materials is currently trading at a notable discount compared to Lam Research Corp. (LRCX), another major player in the semiconductor equipment space. The report suggests that this valuation gap could narrow, estimating a forward discount of 15% compared to the 25% currently observed.

For the fourth quarter, the company expects revenue of $6.7 billion plus/minus $500 million, compared to an analysts’ consensus estimate of $6.714 billion, according to Koyfin data. Applied Materials’ stock has gained over 21% year-to-date and over 1% in the last 12 months.

Also See: Why Is Quantum Computing Stock Falling Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)