Advertisement|Remove ads.

AppLovin Stock Poised For Record Run After Stellar Q4 Results: Retail Thrilled

AppLovin Corp. (APP) shares surged in Thursday’s premarket session following the app marketing platform’s better-than-expected fiscal year 2024 fourth-quarter results and positive forward guidance.

Palo Alto, California-based AppLovin’s fourth-quarter results showed all-round outperformance. The key headline numbers are as follows:

- EPS: $1.73 vs. year ago’s $0.49 and $1.25 consensus estimate

- Revenue: $1.37 billion vs. year ago’s $953.26 million and $1.26-billion consensus estimate and guidance of $1.24 billion to $1.26 billion

- Adjusted earnings before interest, taxes, depreciation and amortization: $848.02 million vs year ago’s $476.16 million and guidance of $740 million to $760 million

- Adjusted EBITA margin: 62% vs. year ago’s 50% and 60% guidance

Advertising revenue, accounting for about 73% of the total, increased 44%, helping to offset a 1% app revenue decline.

AppLovin said it generated free cash flow of $695 million for the fourth quarter.

Among key user metrics, monthly active payers were 1.6 million at the end of the fourth quarter, down from 1.8 million last year. Average revenue per monthly active payer (ARPMAP) increased year over year to $52 from $47.

The company expects first-quarter revenue of $1.355 billion to $1.385 billion, ahead of the Street analysts’ average estimate of $1.32 billion. It forecasts a sequential increase in adjusted EBITDA and adjusted EBITA margin to $855 million—$885 million and 63%-64%, respectively.

In its letter to shareholders, AppLovin said, “We are still in the early stages of improving our advertising AI models.” The company said in 2025 it plans to launch a self-service dashboard powered by AI agents to help its customers manage their campaigns.

Wall Street firms scrambled to raise their price targets for AppLovin stock following the fourth-quarter print, TheFly reported. JPMorgan raised the price target to $475 from $325, Piper Sandler to $575 from $400 and Wedbush to $620 from $545.

JPMorgan analyst Cory Carpenter expressed optimism over the company’s early pilots in verticals beyond e-commerce.

Wedbush analysts said AppLovin is slowly gaining a large share of the $15 billion advertising spend inside mobile games, which stoked the quarterly performance.

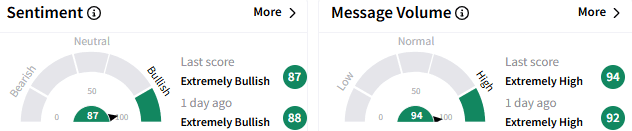

On Stocktwits, sentiment toward AppLovin stock stayed ‘extremely bullish’ (87/100), with the message volume at ‘extremely high’ levels. It is among the top five trending stocks on the platform.

A watcher said valuation is still reasonable when weighed against the growth potential.

Another user sees the stock going past $800 by the middle of the year, thanks to its e-commerce push.

In premarket trading, AppLovin stock jumped 27.50% to $484.89, a record level. The advance marked the biggest one-day gain since Nov. 6, when the stock reacted to the company’s third-quarter results.

The stock has gained over 17% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com

Read Next: Reddit Stock Eyes Sub-$200 Drop As User Growth Worries Eclipse Q4 Beat, Guidance: Retail Turns Wary

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)