Advertisement|Remove ads.

Aptevo Therapeutics Stock Slumps To All-Time Low On Reverse Split Approval

- During the company’s annual meeting in July, shareholders authorized the board to finalize a reverse split within a 1-for-6 to 1-for-20 range.

- The stock will begin trading on a split-adjusted basis on the Nasdaq Capital Market on December 30.

- The company’s net loss for the third quarter widened to $7.5 million from $5.1 million during the year-ago period.

Aptevo Therapeutics Inc. (APVO) stock slumped 45% to an all-time low on Friday after the company announced a 1-for-18 reverse stock split, effective after market hours on December 29.

The reverse split will consolidate 18 outstanding shares into one, with split-adjusted trading set to begin on the Nasdaq Capital Market on December 30. The move will cut Aptevo’s issued and outstanding shares from about 18 million to roughly a million.

Shareholders approved the proposal at the company’s annual meeting on July 24, authorizing the board to finalize a reverse split within a 1-for-6 to 1-for-20 range. The board set the final ratio on December 17.

A reverse stock split is aimed at maintaining the stock’s compliance with Nasdaq’s listing requirements by meeting the $1 minimum bid price requirement.

Aptevo’s Q3 Highlights

The company’s net loss for the third quarter (Q3) widened to $7.5 million, or $2.23 per share, from a loss of $5.1 million, or $357.86 per share, in the previous corresponding period.

It raised $18.7 million during the quarter and an additional $4.1 million after quarter-end, extending its cash runway into the fourth quarter (Q4) of 2026. Aptevo said the runway would support key clinical milestones next year.

Following those results, Aptevo introduced its trispecific antibody, APVO451, designed to counter immune suppression in solid tumors and built on the same binding domain as its lead candidate, Mipletamig, which has demonstrated a favorable safety profile.

How Did Stocktwits Users React?

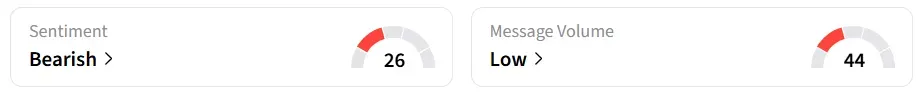

Retail sentiment on Stocktwits around Aptevo Therapeutics trended in the 'bearish' territory at the time of writing.

One user was hopeful of a buyout following the reverse split.

Another user said that the stock could have an attractive setup on Tuesday next week, with the 1-day moving average convergence divergence (MACD) a key indicator for potential entry.

Read also: As 2025 Bids Adieu, A Look At How Mag 7 Stocks Are Positioned On Charts

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)