Advertisement|Remove ads.

Archer Aviation Stock Gains Premarket — Retail Sees New Peaks

Archer Aviation (ACHR) stock gained 4.5% in early premarket trading on Monday amid retail traders’ optimism over the company’s participation in a federal pilot program aimed at faster deployment of air taxis.

The stock had gained 3.1% on Friday after it revealed that it would take part in the program, which was implemented in accordance with a Presidential executive order.

The company added on Friday that it was now exploring pathways to work together with U.S. airlines, including United Airlines, and interested cities under the new program to design and execute trial operations of Archer's Midnight aircraft, as part of the program.

Like its peer Joby Aviation, Archer is competing in the nascent electric vertical take-off and landing (eVTOL) industry. Many large cities worldwide are looking at eVTOL as an alternative to road travel to reduce traffic congestion.

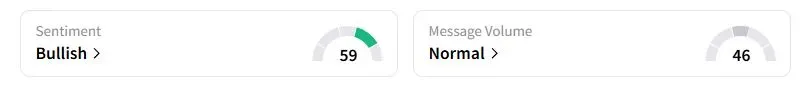

Retail sentiment on Stocktwits about Archer was in the ‘bullish’ territory at the time of writing, while chatter was ‘normal.’

“Getting very positive vibes about the rest of the year with all that's happening internally with Archer, and with the industry in general,” one user said.

Another user said “Won't be surprised” if stock hits $20s by the end of the year with all the catalysts and close to $2 billion in cash.

The stock also has a high short interest rate of 14.9%, according to Koyfin data. In August, Grizzly Research unveiled a short report on Archer, accusing the company of overstating its technological progress and relying on false PR to support its valuation.

Archer stock has fallen 11.8% this year.

Also See: Oil Prices Gain Ahead of Fed Meeting, As Ukraine Steps Up Attacks On Russian Refinery

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)