Advertisement|Remove ads.

Ardelyx Stock Gets Multiple Price Target Cuts After Disappointing Q1 Earnings: But Retail’s Optimistic

Shares of Ardelyx, Inc. (ARDX) traded 22% lower on Friday afternoon after Citi lowered its price target on the stock following its recent first-quarter earnings report.

Citi reduced its price target on Ardelyx to $10 from $11 while keeping a ‘Buy’ rating. The new price target, however, represents an 83% upside to the stock’s closing price on Thursday.

Raymond James also downgraded Ardelyx to ‘Outperform’ from ‘Strong Buy’, and slashed its price target to $11 from $13.

The firm said that recent net sales weakness has created added uncertainty regarding the long-term growth of the Ibsrela and Xphozah franchises.

Despite the downgrade, Raymond James remains bullish on Ardelyx, citing its strong execution track record.

Ardelyx reported Q1 total revenue of $74.1 million on Thursday, marking 61% growth year-over-year and reflecting increased net product sales and licensing revenue. However, as per Finchat data, this was below an analyst estimate of $79.44 million.

U.S. net product sales revenue of Ibsrela, the company’s prescription medication for treating Irritable Bowel Syndrome with Constipation, was $44.4 million, compared to $28.4 million during the same period of 2024.

The U.S. net product sales revenue of Xphozah, used as an add-on therapy to reduce serum phosphorus in adults with chronic kidney disease (CKD) on dialysis, was $23.4 million, compared to $15.2 million during the same period in 2024.

Net loss per share for the quarter was $0.17, compared to a loss of $0.11 per share in the same quarter of 2024, and broader than an estimated loss of $0.07.

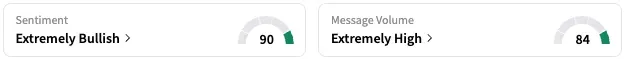

On Stocktwits, retail sentiment around ARDX remained in the ‘extremely bullish’ territory over the past 24 hours while message volume rose to ‘extremely high’ from ‘high’.

ARDX stock is down by over 17% this year and nearly 38% over the past 12 months.

Also See: Volkswagen Core Brand Group Operating Profit Drops In Q1: But Retail’s Not Rattled

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)