Advertisement|Remove ads.

Are Hollywood's Box-Office Blues Finally Over? Major Theater Stocks Give Us The Full Picture

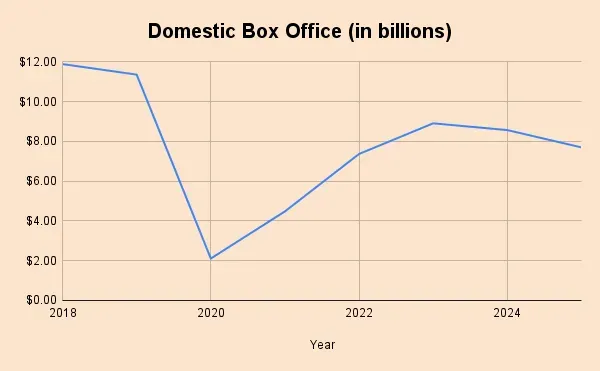

- The COVID-19 pandemic kept theatres shuttered for much of 2020, with domestic box office receipts plunging by over 80%.

- According to PwC, 2030 may be the year global box office revenues return to pre-pandemic levels.

- Cinemark has shown the fastest revenue growth over the past year, although, in absolute terms, AMC generates more revenue than the combined revenue of the other two.

Are big movies finally back to stay? The domestic box office this year was fueled by major hits such as "A Minecraft Movie", the fantasy-adventure adaptation of the 2011 video game; Disney’s live-action "Lilo & Stitch", which has emerged as the year’s top-grossing global release; and "Superman", the Warner Bros. Discovery title that enjoyed a strong domestic run.

The Brad Pitt-starrer "F1: The Movie", a high-octane Formula 1 racing drama produced by Apple and distributed by Warner Bros., became the actor’s highest-grossing film and helped draw moviegoers back into theaters.

Did these major releases help revive the box office — and, in turn, lift theater chains? Let's take a closer look.

Rocky Ride Post COVID

The COVID-19 pandemic kept theaters shuttered for much of 2020, with domestic box office receipts plunging more than 80%. Since then, the recovery has been uneven. Aggregate ticket sales remain below pre-pandemic levels despite sustained efforts by movie chains and studios to entice audiences back.

Data Source: Box Office Mojo

*2025 data is for the period until Dec. 2

PwC’s annual survey suggests U.S. gross ticket sales may not return to pre-pandemic levels by 2029, The Hollywood Reporter noted. The firm forecasts that ticket revenue will reach $10.1 billion in 2025 and gradually rise to a potential $10.8 billion by 2029.

Bart Spiegel, PwC global entertainment and media leader, reportedly said: “Unfortunately, this full recovery is unlikely within the forecast period. However, we project that by the end of 2029, the industry will be on the brink of a full rebound. In other words, 2030 may be the year global box office revenues return to pre-pandemic levels.”

According to the analyst, growth in ticket sales is now more a function of higher ticket pricing than of increased footfalls. Theater chains have succeeded in pushing through the hikes with “enhanced infrastructure and facilities, technological advancements, and rising content costs.” According to Numbers.com, the average ticket price has increased from $9.18 in 2019 to $11.31 in 2025.

That said, theater chains are going all out to win audiences back and counter the pull of streaming giants. AMC CEO Adam Aron announced this week that his company is collaborating with Netflix to show the series finale of "Stranger Things 5" in 200 U.S. theaters on New Year’s Eve and New Year’s Day. In early October, AMC rode the Taylor Swift hype by screening the singer's "The Official Release Party of A Showgirl” as a weekend-only movie.

Still, theater attendance continues to face heavy pressure from streaming platforms. A September AP-NORC poll found that about three-quarters of U.S. adults watched a movie on a streaming service instead of in a theater at least once in the past year — a shift driven primarily by convenience and cost.

How is the “shifting tide” playing out for the fortunes of the major theater chains?

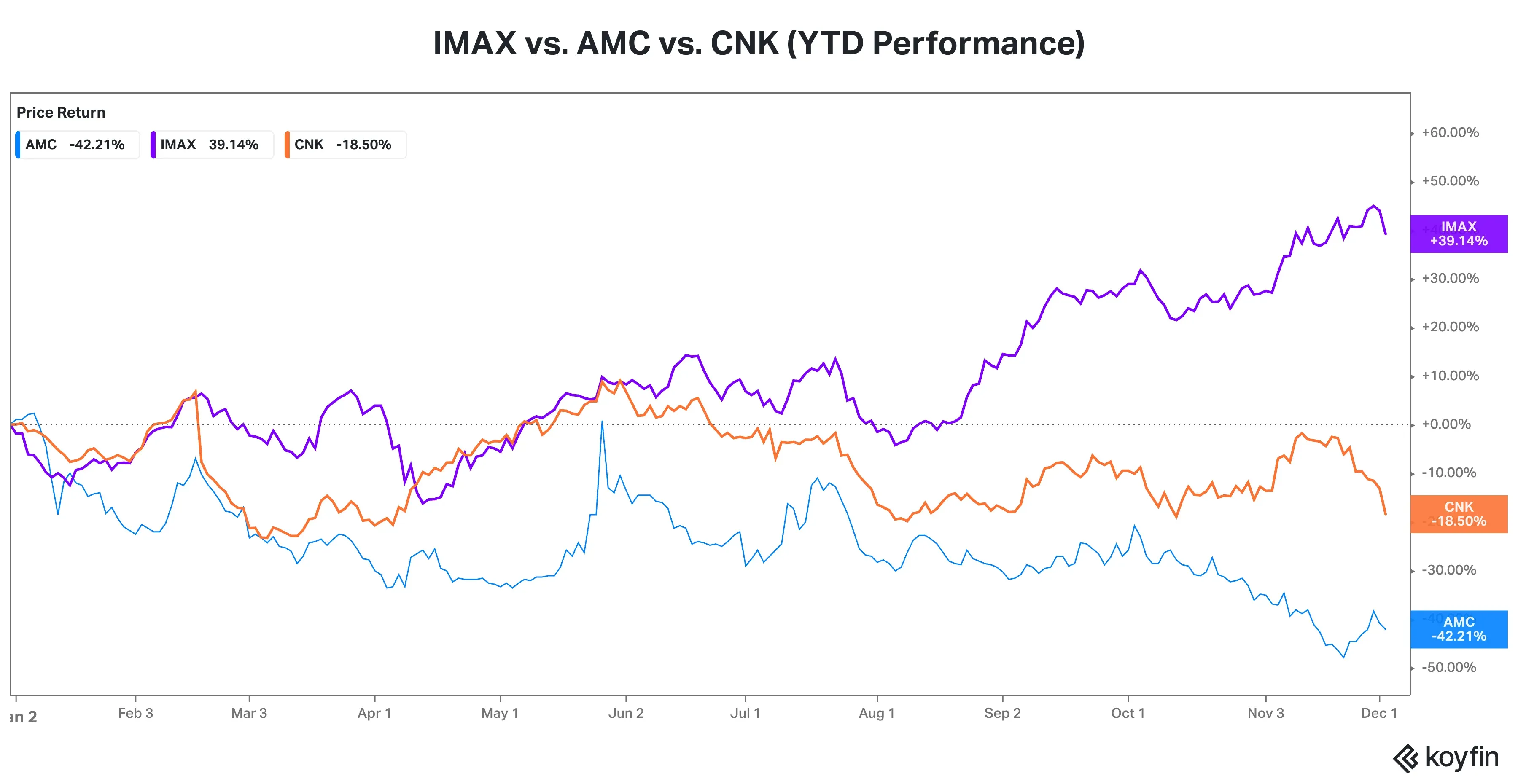

IMAX vs. AMC vs. Cinemark: How Returns Stack Up

Only IMAX shares among the trio are trading in the green for the year. New York-based IMAX boasts of providing the “most immersive film experience” through its high-resolution cameras, film formats, film projectors, and theaters. AMC stock, which had its heyday during the 2021 meme mania, is down a staggering 42% for the year. Meanwhile, Cinemark is down a more modest 18.50%.

Source: Koyfin

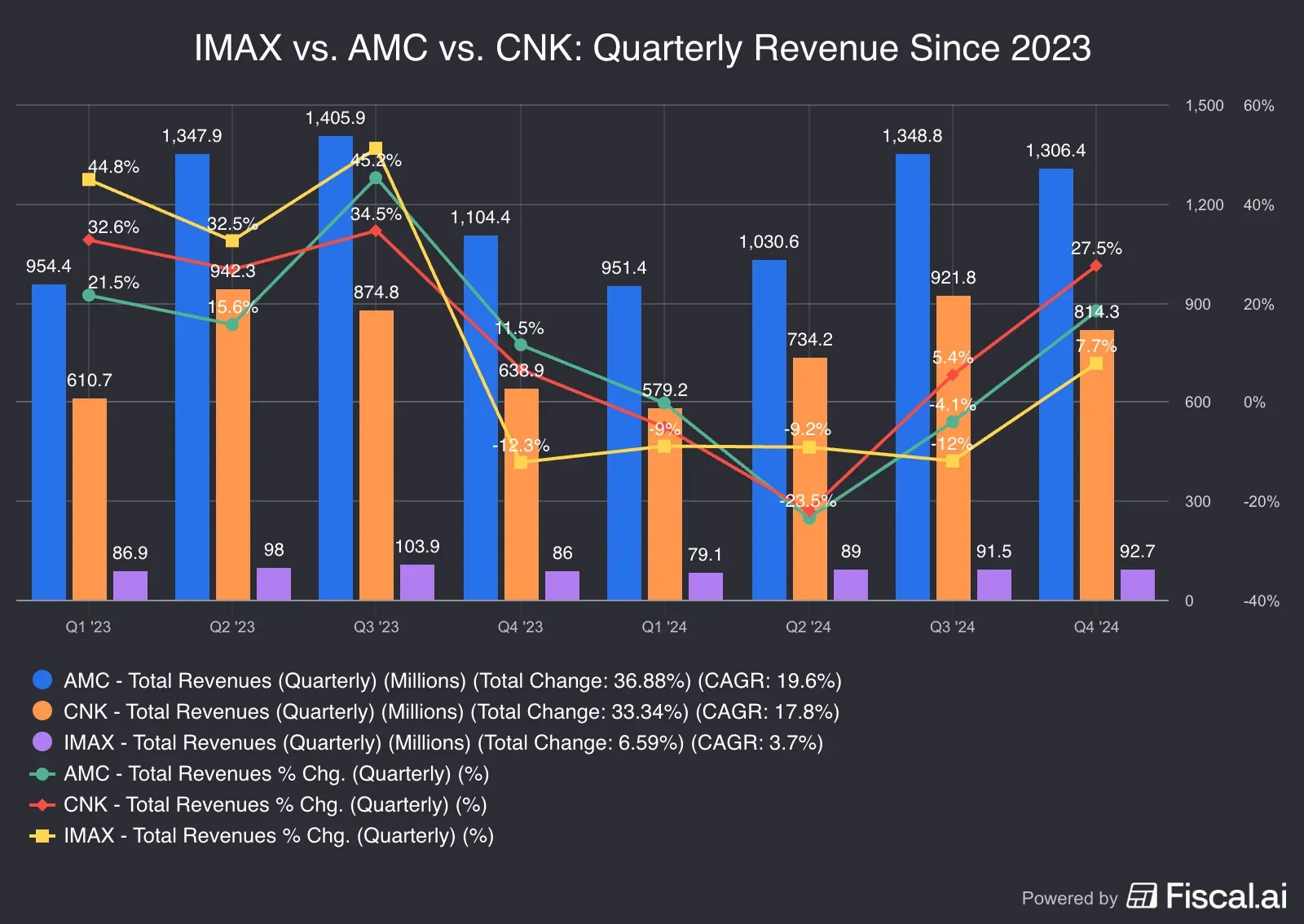

IMAX vs. AMC vs. CNK: How Fundamentals Stack Up

Cinemark has shown the fastest revenue growth over the past year, although, in absolute terms, AMC generates more revenue than the combined revenue of the other two. Plano, Texas-based Cinemark operates about 500 theaters and more than 5,500 screens compared to AMC’s 600 theaters and 8,200 screens.

Source: Fiscal.ai

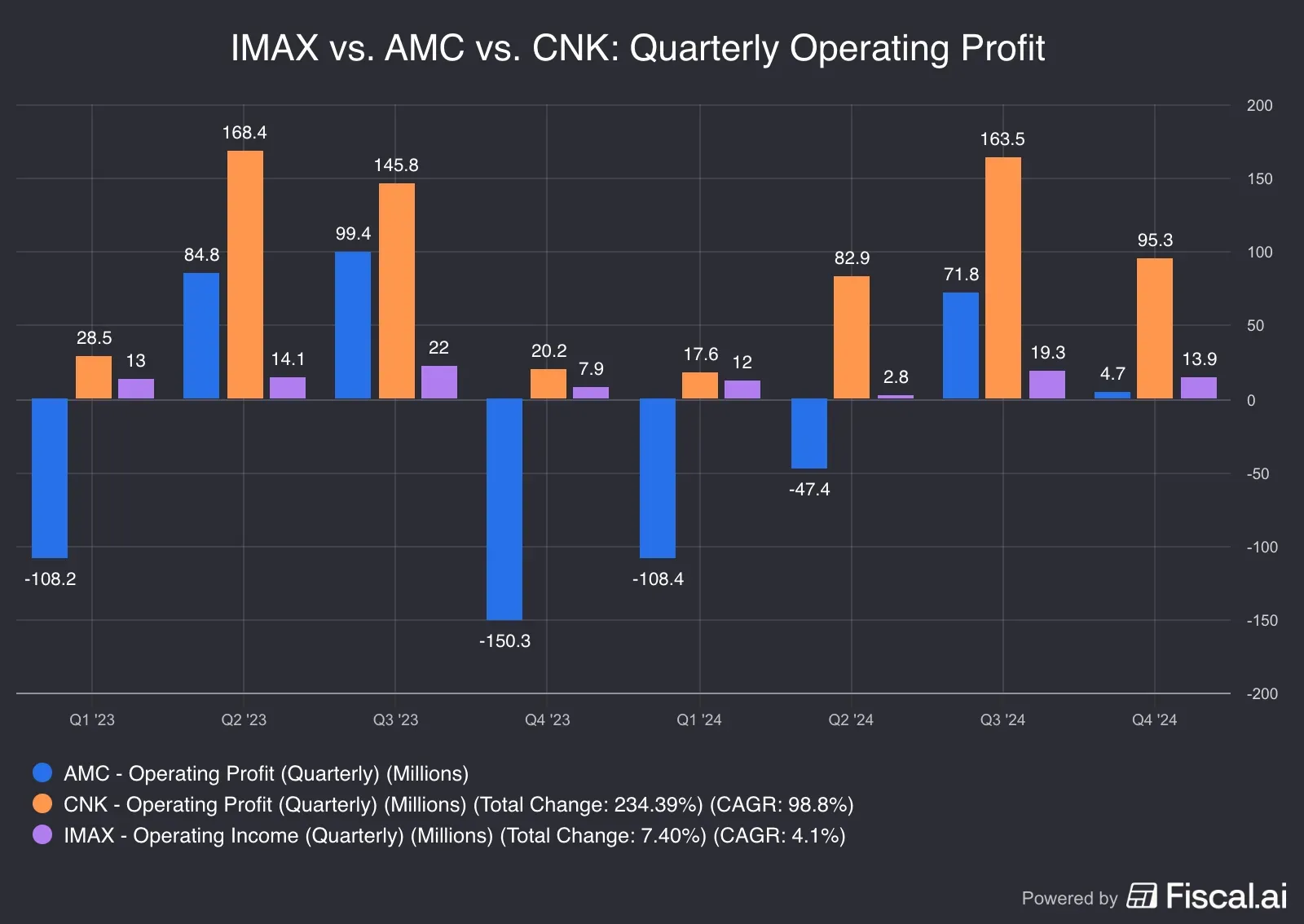

On the other hand, in terms of operating profits, Cinemark leads, followed by IMAX.

Source: Fiscal.ai

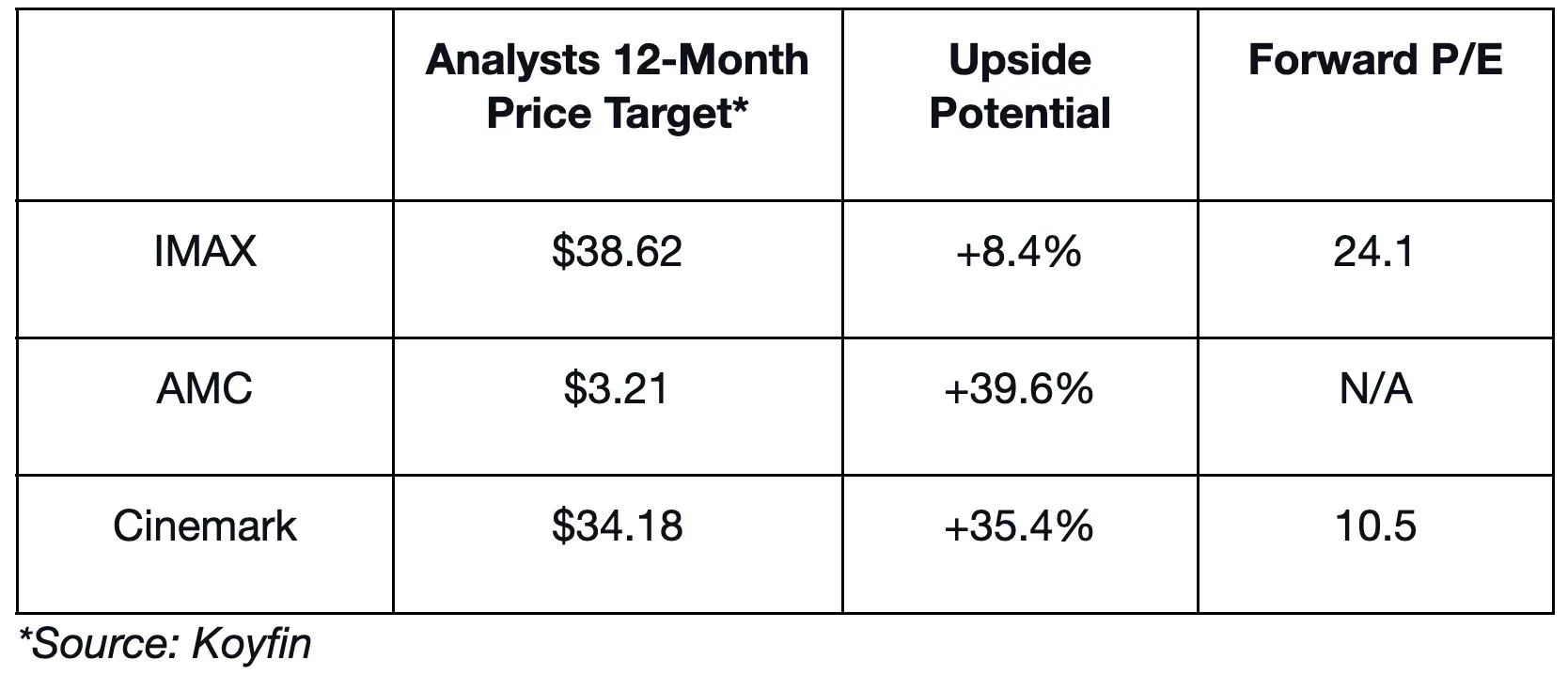

IMAX vs AMC vs CNK: How Sell, Retail Are Positioned

AMC — long criticized for balance-sheet indiscipline — reported a Q3 net loss of $298.2 million in November, primarily due to non-cash charges tied to a July 2025 refinancing that fully redeemed its 2026 maturities.

Cinemark, meanwhile, has paid off its pandemic-era debt and reduced net leverage. In a note following Cinemark's Q3 results, JPMorgan highlighted the company's improving financial flexibility to reinvest in the business and return capital to shareholders, according to The Fly.

On Stocktwits, retail investors are 'bearish' on IMAX, while feeling 'neutral' about AMC and Cinemark.

Even during the November market sell-off, IMAX held up well, gaining nearly 10%, while Cinemark and AMC slid more than 6% and 11%, respectively. Last month, Goldman Sachs upgraded IMAX to Neutral from Sell and raised its price target to $34 from $22, citing a higher multiple to reflect IMAX's strategic importance within the media ecosystem.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)