Advertisement|Remove ads.

AST SpaceMobile Cuts $225M In Debt With Stock Sale: Retail Rushes In To Buy The Dip

Satellite communications firm AST SpaceMobile, Inc.(ASTS) on Wednesday announced a major step toward reducing its debt obligations by repurchasing a substantial portion of its convertible notes to strengthen its balance sheet while addressing concerns about shareholder dilution.

AST SpaceMobile’s stock traded over 6% lower in Wednesday’s premarket session.

The company confirmed it will buy back $225 million worth of its 4.25% convertible notes due 2032, through privately negotiated deals with select noteholders and a registered direct share offering.

The repurchase will wipe out approximately $63.8 million in future interest payments.

As part of the repurchase arrangement, the company will issue 9.45 million new shares of Class A common stock at $53.22 per share to the noteholders who are participating.

The deal is structured so that proceeds from the offering directly fund the repurchase. This transaction effectively retires a significant chunk of AST SpaceMobile’s outstanding debt, while still leaving $235 million in principal notes on its books.

Although the issuance of new stock may suggest potential dilution, the company noted that these transactions would free up more than 8.3 million shares previously reserved for conversion, which can now be allocated elsewhere or withheld from issuance entirely.

This results in a relatively modest increase in outstanding shares, approximately 1.04 million.

Investors holding the notes may choose to adjust their hedge positions in response, potentially affecting short-term market dynamics for the company's stock.

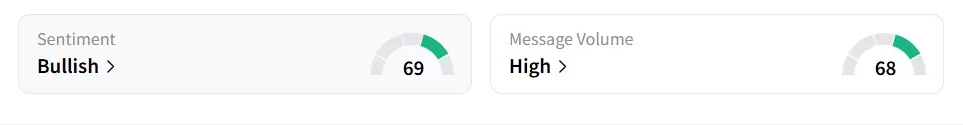

On Stocktwits, retail sentiment toward AST SpaceMobile remained in ‘bullish’ territory amid ‘high’ message volume.

A Stocktwits user said they are buying the dip.

Another user lauded the company’s move to reduce debt.

AST SpaceMobile stock has more than doubled in 2025 and more than quadrupled in the last 12 months.

Also See: Micron Stock In Spotlight Amid Valuation Concerns Ahead Of Q3 Results — Retail Stays Optimistic

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Lucid_jpg_221b9d07ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Draft_Kings_jpg_c77a08f48a.webp)