Advertisement|Remove ads.

AST SpaceMobile Stock Tumbles As Losses Widen Sharply In Q3: But Retail Stays Defiant

Shares of AST SpaceMobile Inc ($ASTS) fell nearly 14% on Friday morning as investors focused on the sharp rise in the firm’s quarterly losses, largely ignoring its major launch service agreements.

AST SpaceMobile announced a revenue of $1.1 million during the third quarter but reported net losses of $171.95 million, significantly higher than $20.91 million recorded in the same quarter a year ago. The losses were driven by a $236.91 million hit due to a loss on re-measurement of warrant liabilities.

Founder and CEO Abel Avellan with the first five BlueBird satellites successfully unfolded and entering initial operations, the company’s business is progressing according to plan.

“We’ve advanced our strategy across multiple efforts including progress on securing orbital launch capacity, growing our manufacturing capability, and expanding our customer ecosystem,” he said.

The company also announced many launch services agreements securing the orbital launch capacity to enable continuous space-based cellular broadband service coverage across many markets globally.

AST SpaceMobile said its global service will initially target key markets such as the United States, Europe, Japan, the U.S. Government and other strategic markets.

The firm said that the Cape Canaveral Florida Space Force Station launch campaign, scheduled during 2025 and 2026, will utilize existing launch vehicles and Blue Origin’s New Glenn rocket for up to approximately 60 Block 2 satellites to low Earth orbit.

The company also said it received $153.3 million in net proceeds from the redemption of publicly traded warrants and that it repaid $48.5 million of senior secured credit facility in the fourth quarter.

Despite the disappointing earnings, retail investors on Stocktwits appear to be focusing on the firm’s business updates.

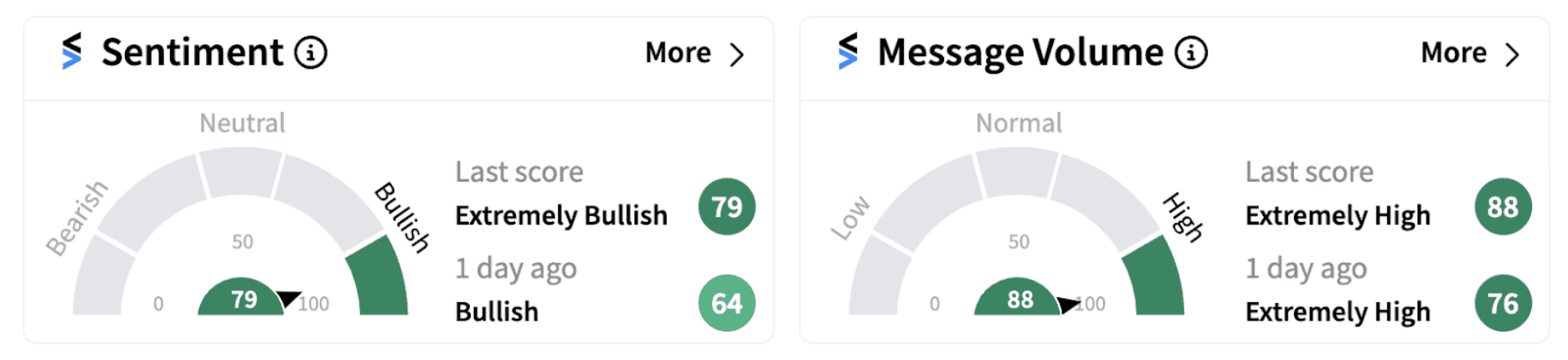

The Stocktwits sentiment meter jumped into the ‘extremely bullish’ territory (79/100) on Friday morning from ‘bullish’ a day ago, accompanied by ‘extremely high’ retail chatter.

Many Stocktwits users are considering the decline in stock price as a buying opportunity.

Also See: Fed Chair Jerome Powell Sees No Economic Signals For Hurried Rate Cuts

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vlad_tenev_robinhood_CEO_OG_jpg_bf3a4c4bee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Deere_resized_a913c16f0a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_b2gold_jpg_2d344842dd.webp)