Advertisement|Remove ads.

Fed Chair Jerome Powell Sees No Economic Signals For Hurried Rate Cuts

Federal Reserve Chair Jerome Powell said on Thursday that the economy is not sending any signals which indicated there is a need to be in a hurry to lower rates, sparking doubts on the pace of rate reductions in the coming months.

“The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully. Ultimately, the path of the policy rate will depend on how the incoming data and the economic outlook evolve,” Powell said in his speech.

Powell noted that the labor market has cooled to the point where it is no longer a source of significant inflationary pressures but also said the central bank is closely tracking the gradual decline in housing services inflation, which has yet to fully normalize.

“Inflation is running much closer to our 2% longer-run goal, but it is not there yet. We are committed to finishing the job. With labor market conditions in rough balance and inflation expectations well anchored, I expect inflation to continue to come down toward our 2% objective, albeit on a sometimes-bumpy path,” he said.

The Fed Chair remains confident that with an appropriate recalibration of its policy stance, strength in the economy and the labor market can be maintained, with inflation moving sustainably down to 2%.

“We see the risks to achieving our employment and inflation goals as being roughly in balance, and we are attentive to the risks to both sides. We know that reducing policy restraint too quickly could hinder progress on inflation. At the same time, reducing policy restraint too slowly could unduly weaken economic activity and employment,” he said.

Although the strength in the economy appears to have provided some relief to skeptics worried about a “hard landing,” concerns have now surfaced regarding the pace of rate cuts in the coming times.

Meanwhile, U.S. retail sales data released by the Department of Commerce showed that the value of retail purchases rose 0.4% in October after an upward revision of 0.8% gain in September.

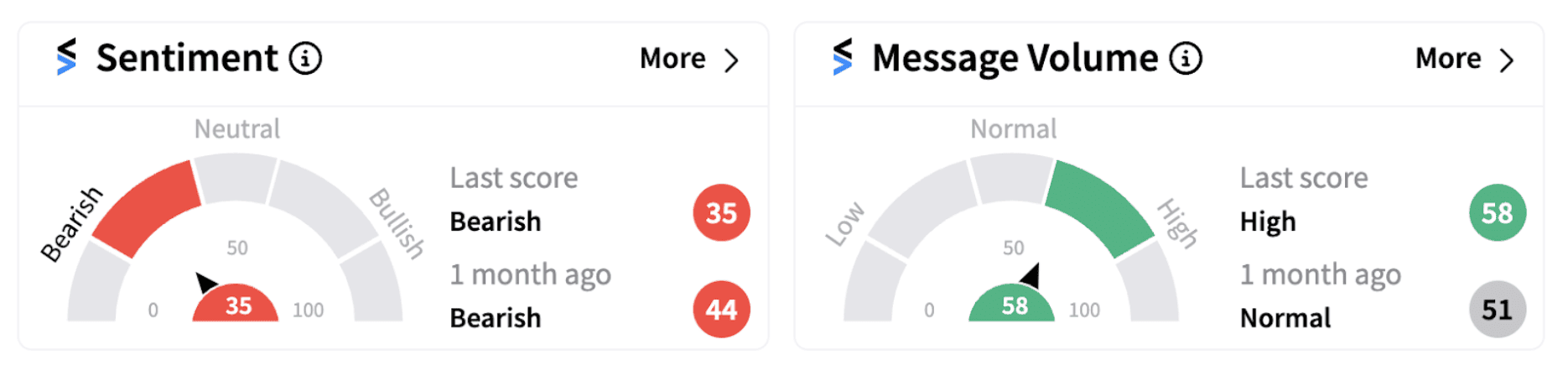

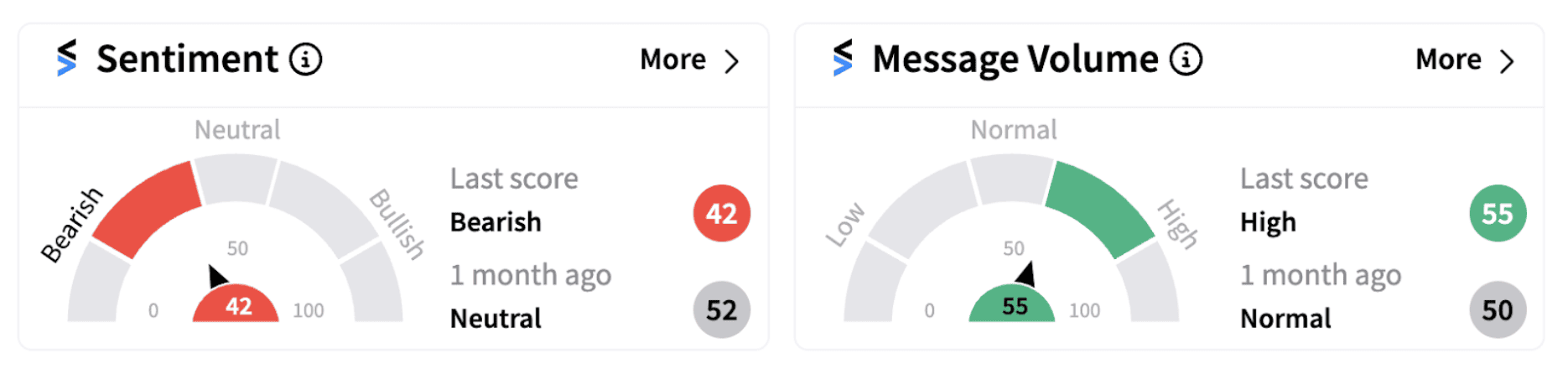

The markets, too, were trending in the red in Friday’s pre-market session. The SPDR S&P 500 ETF Trust ($SPY) was trading 0.4% lower while the Invesco QQQ Trust, Series 1 ($QQQ) was trading nearly 0.76% lower on Friday morning.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vlad_tenev_robinhood_CEO_OG_jpg_bf3a4c4bee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Deere_resized_a913c16f0a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_b2gold_jpg_2d344842dd.webp)