Advertisement|Remove ads.

AI Chipmaker Astera Labs Jumps Ahead Of Q4 Earnings As Tech Giants Ramp Up Spending, Retail Sentiment Gets A Lift

Astera Labs (ALAB) rose more than 1% in pre-market trading Monday as investors looked ahead to the chipmaker’s fourth-quarter earnings report, scheduled for release after the market close.

Analysts expect the semiconductor specialist to post earnings of $0.26 per share on revenue of $128 million, according to Stocktwits data.

Retail investors will be watching for management's outlook on AI-driven semiconductor demand, especially after the market panic driven by China’s DeepSeek.

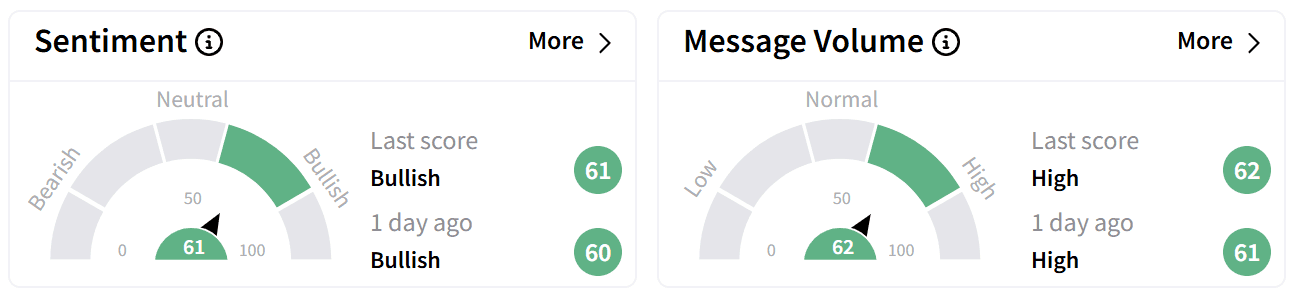

On Stocktwits, the retail sentiment around Astera remained ‘bullish’ and was accompanied by ‘high’ levels of chatter in pre-market trade on Monday.

Platform data shows chatter around Astera has surged 375% over the past three months and jumped 171% in the last month alone.

The number of investors following the chip maker on Stocktwits has increased by 44% over three months and by more than 8.5% in the past month.

Astera’s stock is still recovering from a sharp selloff in late January when DeepSeek, a Chinese startup, unveiled a low-cost AI model that reignited concerns about U.S. companies overinvesting in the hot sector. The news sent Astera shares tumbling 28% in a single session.

Morgan Stanley responded by cutting its price target on the stock to $114 from $142 while maintaining an ‘Equal Weight’ rating.

The brokerage warned that DeepSeek’s emergence could lead to stricter export controls or dampen AI-related capital expenditures among U.S. tech giants. However, the analysts remain broadly optimistic about the sector.

Northland Capital took the opposite stance, upgrading Astera Labs to ‘Outperform’ from ‘Market Perform’ with a $120 price target.

The analyst had correctly anticipated that major AI investors — Amazon (AMZN), Alphabet (GOOGL), Meta (META), and Microsoft (MSFT) — would maintain or even raise their capital spending, which could serve as a tailwind for Astera.

Recent earnings reports from the sector’s biggest spenders have reinforced bullish sentiment.

The average analyst price target stands at $117.32 on Koyfin, implying 15.8% upside from Friday’s close.

Of the 14 analysts covering Astera, 12 rate the stock as a ‘Buy’ or equivalent recommendation.

Bullish users on Stocktwits are estimating the stock’s price to rise to at least $112 after the company’s fourth-quarter earnings, with some even seeing $150 on the horizon.

Despite doubling in value over the past year — rising 92.7% — Astera’s stock is down more than 22% year-to-date, weighed by concerns over DeepSeek’s impact and broader AI industry trends.

Investors will be closely watching Monday’s earnings report for any commentary on AI-driven demand, supply chain challenges, and management’s outlook for 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Nvidia Shares Hold Steady On Amazon’s Endorsement of AI Partnership But Retail Remains Uncertain

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_1ebecab605.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_ATM_5257ead046.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_qatarenergy_jpg_907aa26daf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243817419_jpg_fd782b2997.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191224409_jpg_fd3e69e2d7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)