Advertisement|Remove ads.

Astronics Corp Stock Rises After-Hours As Q4 Profit Tops Estimates, Retail’s Yet To Take Notice

Astronics Corp (ATRO) stock gained 10.5% after the company’s fourth-quarter earnings topped Wall Street’s estimates.

The aerospace electronics firm posted adjusted net income of $16.8 million, or $0.48 per share, while analysts on average expected the company to post $0.17 per share, according to FinChat data.

The company’s fourth quarter sales rose 6.8% to $208.5 million compared to the year-ago quarter and exceeded Wall Street’s expectations.

However, due to debt extinguishment commitments, it reported a net loss of $2.8 million, or $0.08 per share, compared with a net income of $7.0 million, or $0.20 per share, in the prior-year period.

It also included a $4.8 million reserve regarding a patent infringement dispute with Lufthansa. In February, a UK court ruled Astronics to pay about $11.9 million as a damage award for infringement.

Sales in the aerospace segment jumped 11.7% to $188.5 million, driven by a 13.5% increase in Commercial Transport sales.

The company attributed the rise to increased airline demand for cabin power and inflight entertainment & connectivity products, which was somewhat offset by lower sales of commercial lighting and safety products resulting from the Boeing strike.

However, its Test Systems segment sales declined by $6.6 million to $20 million during the fourth quarter.

The company said backlog at the end of the quarter was $599.2 million, the highest for any year-end.

Astronics expects 2025 revenue to be about $820 million to $860 million. Wall Street expects it to post $842.5 million.

“We expect growth to moderate in 2025, but margin improvement to continue,” CEO Peter Gundermann said.

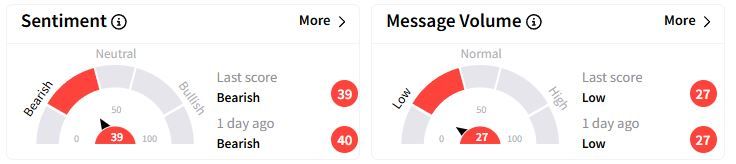

Retail sentiment on Stocktwits remained in the ‘bearish’ (39/100) territory, while retail chatter was ‘low.’

Over the past year, Astronics shares have gained 4.7%.

Also See: Orion Group Tumbles After-Hours On Q4 Revenue Miss, Tepid 2025 Outlook: Retail Stays Bearish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_optoelectronics_wafer_production_resized_759caf364b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_duolingo_resized_jpg_b62f52b726.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_purple_jpg_faad1be151.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259270325_jpg_4fbb248789.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)