Advertisement|Remove ads.

Orion Group Tumbles After-Hours On Q4 Revenue Miss, Tepid 2025 Outlook: Retail Stays Bearish

Orion Group (ORN) stock fell 11% in extended trading on Tuesday after the specialty construction company’s fourth quarter revenue missed Wall Street’s estimates.

The company posted quarterly revenue of $216.9 million, while analysts, on average, expected the company to post $271.7 million, according to FinChat data.

However, revenue grew 7.6% compared to the year-ago quarter due to a rise in both the Marine and Concrete segment revenue.

It reported adjusted net income of $6.4 million or $0.16 per share, for the quarter ended Dec. 31, compared with Wall Street’s estimated $0.15 per share.

Orion reported a net income of $6.8 million, or $0.17 per share for the fourth quarter, compared to a loss of $4.4 million, or $0.13 per share, in the year-ago quarter.

The company projected 2025 revenue between $800 million and $850 million, compared with Wall Street’s expectations of $850.5 million.

It also forecasted adjusted earnings between $0.11 and $0.17 per share this year, below Wall Street’s estimated $0.26 per share.

The company said it has won almost $250 million of new contract awards in the first quarter till now.

The Houston, Texas-based company said its total backlog stood at $729.1 million at the end of Dec. 31, 2024, compared with $762.2 million at the end of 2023.

The company said opportunities continue to be immense at its Marine segment, which provides services such as marine pipeline construction, marine environmental structures, and waterway dredging.

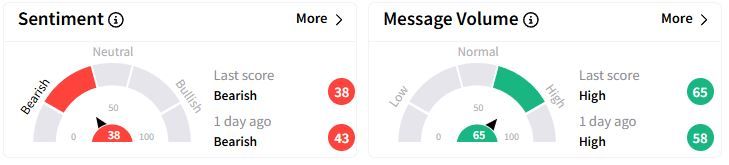

Retail sentiment on Stocktwits moved lower into the ‘bearish’ (38/100) territory than a day ago, while retail chatter was ‘high.’

Over the past year, Orion Group’s shares have fallen 4.9%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)