Advertisement|Remove ads.

AST SpaceMobile Gives Up Early Gains After Securing US Govt Contract: Retail Loses Nerves

Shares of AST SpaceMobile Inc. ($ASTS) experienced a volatile trading day on Thursday, initially rising by 16% in the morning before slipping over 1.5% by the afternoon.

The fluctuations followed the company’s announcement of its selection by the Space Development Agency (SDA) for an Other Transaction (OT) agreement under the Hybrid Acquisition for proliferated Low-earth Orbit (HALO) program.

This contract allows AST SpaceMobile to compete as a prime contractor for prototype demonstration projects, showcasing the scalability of its technology for various government applications.

Despite the positive news, profit-taking appeared to have set in as midday approached.

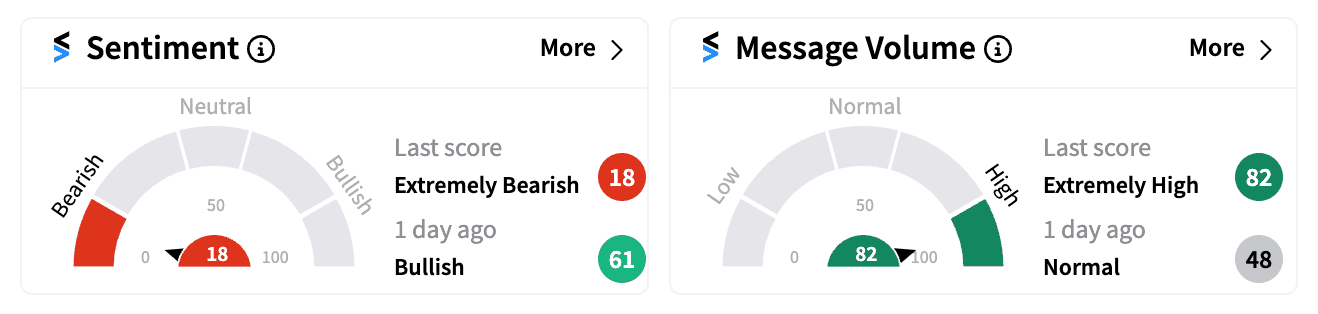

Retail sentiment on Stocktwits plunged to ‘extremely bearish’ (18/100) by 1:30 PM ET, down from a ‘bullish’ rating the previous day.

One user commented on the stock’s struggle to break the $30 barrier, citing heavy selling pressure and questioning the company’s ability to justify its market cap without substantial revenues.

The sentiment among investors reflected frustration, with one user recalling a time when the stock traded at $39 and expressing skepticism about the outlook.

Last month, AST SpaceMobile successfully launched its first five commercial satellites, known as BlueBirds, which are equipped with the largest commercial communications arrays deployed in low Earth orbit.

The company aims to enhance global cellular connectivity, partnering with AT&T and Verizon to support beta testing and expand coverage across the U.S. with over 5,600 cells.

Despite Thursday’s dip, AST SpaceMobile shares have surged 430% this year, significantly outpacing broader market trends as investors recognize the company’s potential in space communications.

Additionally, the company has gained traction on Stocktwits, with its follower count increasing by 45% over the past year as it transitioned from a small-cap to a mid-cap company.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitdeer_0adcf9a760.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254687746_jpg_9f8228b6ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cfpb_resized_png_ad08d8de38.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_52154609_jpg_bc5ad676b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Musk_Space_X_jpg_28cee07c59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nvidia_jpg_7ed87bb07c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)