Advertisement|Remove ads.

AT&T Offloads Remaining 70% Stake In DirecTV To TPG For $7.6B: Retail Stays Cautious

Shares of AT&T (T) were trading over 1% higher in Monday’s pre-market session after the firm said it is selling its remaining stake in DirecTV Entertainment Holdings to private equity firm TPG.

AT&T will sell its 70% stake in DirecTV for which it expects to receive approximately $7.6 billion in cash payments from DirecTV and TPG through 2029, it said in an SEC filing. TPG will invest in DirecTV through TPG Capital, the firm’s U.S. and European private equity platform.

This includes $1.7 billion of pre-tax quarterly distributions in the second half of 2024, $5.4 billion of after-tax cash distributions and other payments not subject to tax in 2025, and $0.5 billion of final payments in 2029 of after-tax proceeds.

DirecTV has operated as a joint venture between AT&T and TPG since 2021, consisting of DirecTV, DirecTV STREAM and U-verse video services, previously owned and operated by AT&T.

TPG partner David Trujillo believes following the transaction, DirecTV will be in a stronger position to reinvigorate its core product offerings and accelerate investment in its next-generation streaming service.

AT&T said the transaction, which is expected to close in the second half of 2025, continues to strengthen its balance sheet by pulling forward cash expected over the next several years.

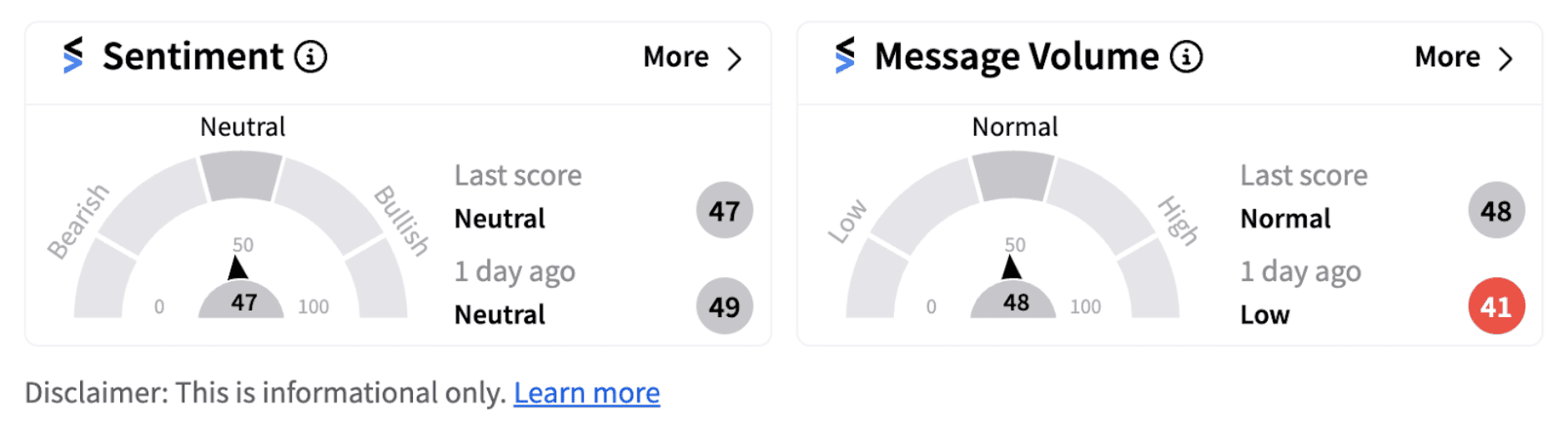

Following the announcement, retail sentiment on Stocktwits continued to remain in the ‘neutral’ territory (47/100).

AT&T had acquired DirecTV nearly a decade ago for $48.5 billion in its bid to gain subscribers and compete against rivals. However, with streaming services like Netflix gaining traction, many customers shifted their preferences, canceling their satellite TV subscriptions.

Meanwhile, DirectTV has announced that it has entered into a definitive agreement with EchoStar (SATS) under which DirectTV will acquire EchoStar’s video distribution business DISH DBS, including DISH TV and Sling TV, through a debt exchange transaction.

One Stocktwits user with a ‘bullish’ view believes AT&T’s purchase of DirecTV was a mistake and the market is likely to take the stake sale news positively.

AT&T shares have gained nearly 27% since the beginning of the year. It recently crossed above a long-term resistance of about $21.50 and continues to sustain above the level, something that is likely to be considered as a positive by technical analysts.

Also See: NIO Stock Soars Pre-Market on $1.9B Investment Boost: Retail Bets On Long-Term Growth

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)