Advertisement|Remove ads.

BEL Order Lifts Avantel – Stock Has Gained 36% In One Month

Telecom equipment manufacturer Avantel has been on a strong run lately. The stock has advanced in four of the past five sessions, rising nearly 10% during this period.

On Thursday, the stock reversed early losses to gain as much as 4% after securing a purchase order from Bharat Electronics (BEL).

According to a press release dated September 18, Avantel received a purchase order worth ₹12.51 crore from Bharat Electronics for the supply of satellite communication (satcom) products.

The domestic order involves a manufacturing contract with a performance bank guarantee of 3%. It is scheduled for execution by March 2026.

Multiple Order Wins

The latest contract with BEL marks Avantel’s fourth order win in September.

On September 8, it received a purchase order worth ₹9.88 crore from the Department of Atomic Energy, followed by another purchase order worth ₹9.92 crore from Garden Reach Shipbuilders for the supply of satellite communication (satcom) products.

On September 17, Avantel signed a maintenance contract worth ₹1.94 crore from the Fleet Maintenance Unit.

Stock Watch

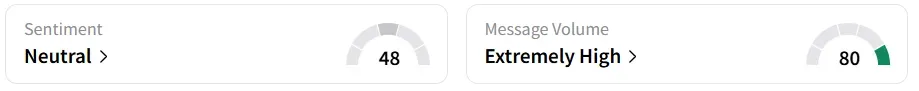

Avantel’s stock has gained nearly 23% in September alone. This has brought in significant investor interest in the stock, with retail chatter ‘extremely high’ on Stocktwits.

Sentiment improved to ‘neutral’ from ‘extremely bullish’ a day earlier.

In a one-month timeframe, Avantel’s shares have gained over 36% and its year-to-date gains stand at 22.8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cigna_shares_resized_2250d1271f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250352860_jpg_45946f3f12.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)