Advertisement|Remove ads.

AmEx Stock Dips Pre-Market On Q3 Revenue Miss, But Retail Focuses On Bright Spots

Shares of American Express Co. ($AXP) dropped nearly 3% pre-market on Friday after reporting third-quarter financial results that missed revenue expectations. Despite this, retail investors on Stocktwits were more optimistic.

American Express posted third-quarter revenue of $16.64 billion, up 8% year-over-year, but falling just short of the consensus estimate of $16.68 billion.

The company also reported $1.4 billion in consolidated provisions for credit losses, up from $1.2 billion a year earlier, due to higher net write-offs stemming from growing loan balances.

The slight revenue miss and increased credit-loss provisions caused some concern among investors ahead of the market opening.

However, retail sentiment on Stocktwits focused on the positives, with many pointing to the company’s growing strengths.

The reported quarter marked AmEx’s tenth consecutive quarter of record revenue.

The company reported net income of $2.51 billion, or $3.49 per share, exceeding analysts’ estimates of $3.29 per share and beating last year’s figure of $2.45 billion, or $3.30 per share.

American Express also raised its full-year earnings guidance to a range of $13.75 to $14.05 per share, up from the previous range of $13.30 to $13.80.

Key highlights included an 18% growth in card-fee revenue and 3.3 million new card acquisitions in the third quarter.

AmEx’s CEO, Stephen Squeri, attributed much of that success to the company’s appeal to Millennial and Gen-Z consumers, noting that 80% of the new accounts on the U.S. Consumer Gold Card were from this demographic.

Squeri emphasized that product refreshes in popular categories like dining are fueling growth and reinforcing confidence in AmEx’s strategy to meet the financial and lifestyle needs of customers.

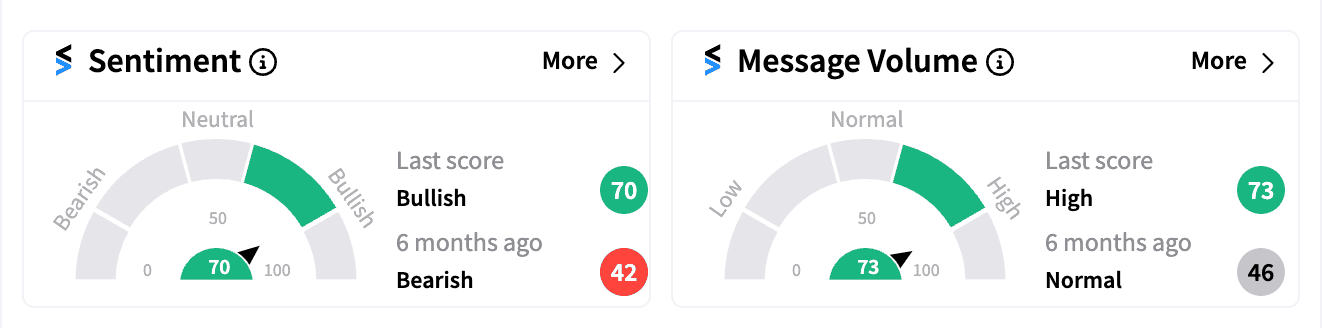

On Stocktwits, retail sentiment turned ‘bullish’ as of 7:45 a.m. ET, versus a ‘bearish’ mood a day ago.

Many users suggested that pre-market selling was likely due to profit-taking, rather than concerns about the company’s fundamentals.

American Express stock has surged over 50% this year, including a 30% spike over the past six months.

Read next: Netflix Stock Jumps After Earnings Beat: Wall Street Applauds, Stocktwits Sentiment Muted

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)