Advertisement|Remove ads.

Axsome Therapeutics Stock Slips On Bigger-Than-Feared Q4 Loss, But Retail Takes It In Stride

Axsome Therapeutics Inc. shares dipped over 2% on Tuesday — their worst session in nearly two weeks — after the company posted a larger-than-expected quarterly loss.

The biotech firm reported an adjusted fourth-quarter (Q4) loss of $1.54 per share, missing estimates of $1.00 per share, while revenue of $118.8 million slightly topped the consensus of $117.84 million.

Despite the earnings miss, Axsome's CEO Herriot Tabuteau struck an optimistic tone, citing strong commercial growth, a rapidly advancing pipeline, and the recent U.S. approval of Symbravo for migraine treatment.

"With potentially five marketed products across six CNS indications of great unmet need over the next 12-18 months, we are well positioned to continue delivering innovative new medicines to patients and significant near- and long-term value to shareholders," Tabuteau said.

The company also stated that its cash reserves are sufficient to fund operations until reaching cash flow positivity.

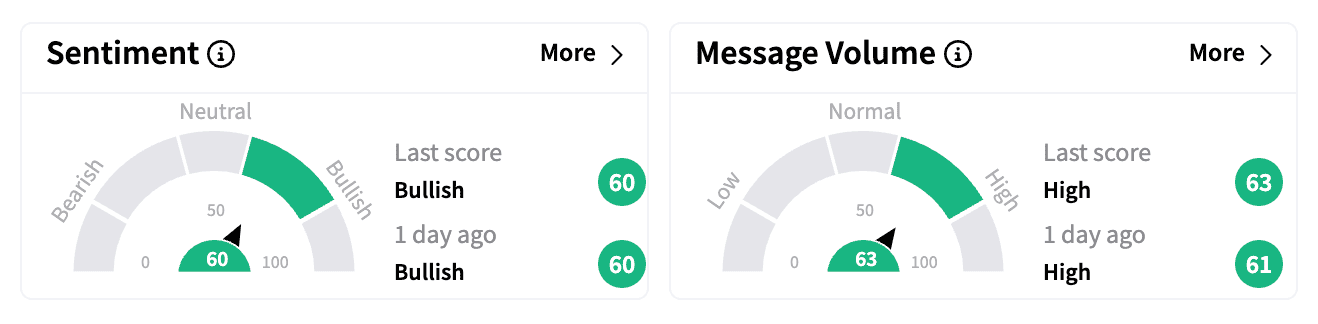

Retail traders on Stocktwits remained 'bullish' post-earnings, with message volume climbing.

One user dismissed concerns over the earnings miss, noting Axsome's long-term growth.

Another emphasized the company's strong balance sheet and promising pipeline.

Axsome said its cash and cash equivalents totaled $315.4 million at the end of last year, compared to $386.2 million a year earlier.

Truist Securities reportedly raised its price target on Axsome to $200 from $190, maintaining a 'Buy' rating.

Last week, Wells Fargo highlighted Axsome's Auvelity patent settlement with Teva Pharmaceuticals (TEVA) as a key de-risking event, according to The Fly.

It said the IP overhang is lifted, and visibility into a second growth phase is improving with the approval of Symbravo and positive Alzheimer's data for AXS-05.

The research firm sees further upside in 2025, driven by commercial performance and data readouts of its sleep disorder treatment, solriamfetol.

Axsome shares are up more than 50% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)