Advertisement|Remove ads.

Boeing Stock Dips As Union Strike Halts Production, Retail Sentiment Sours

Shares of Boeing Co. (BA) dropped more than 1% early on Friday after factory workers walked off the job, reportedly marking the first strike at the aerospace giant in 16 years.

The strike halted manufacturing at Boeing’s Seattle hub after the company’s largest union, the International Association of Machinists and Aerospace Workers (IAM), overwhelmingly rejected a contract offer.

The IAM, which represents 33,000 Boeing employees on the U.S. West Coast, expressed disappointment but remained resolute. "We will make every resource available for our members during this challenging time," the union said, adding that the focus would now shift to negotiating a stronger agreement that meets workers' demands.

The rejected deal proposed a 25% wage increase over four years, expiring in September 2028. However, workers were pushing for a 40% pay hike and the reinstatement of traditional pensions that were eliminated in 2013. Analysts at Jefferies estimated that meeting these demands would add $1.5 billion to Boeing's cash needs.

Newly appointed CEO Kelly Ortberg, who took the helm just weeks ago, had been tasked with restoring faith in the troubled planemaker.

Boeing stated its willingness to renegotiate, signaling potential concessions to end the strike. “We remain committed to resetting our relationship with our employees and the union, and we are ready to get back to the table,” the company said in a statement.

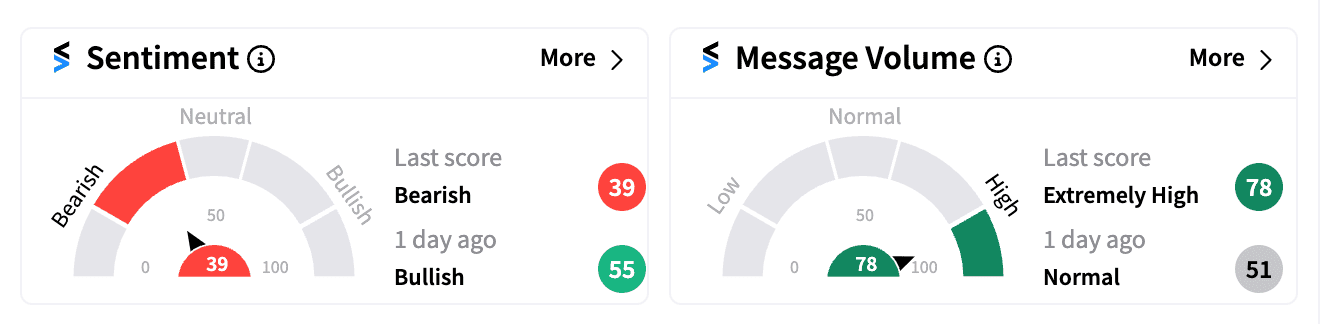

Retail investors are growing ‘bearish’ on Boeing, as seen on Stocktwits, where sentiment among the company’s 185,000 followers plunged.

Many lamented the strike as another setback for Boeing, which has already lost over 35% of its market value this year, shedding more than $55 billion.

“$BA in 2022, this went to 120… the 2008 strike was a disaster. let’s see 135-145,” noted one user.

“$BA just when you think it can’t get any worse… what a disaster this company is,” another posted.

One user, however, predicts that the stock would “dip for 3-4 days and bounce around that level in until any news breaks about a possible agreement.”

Boeing’s stock has been hammered by a series of challenges, including the fallout from fatal crashes linked to design flaws, accusations of prioritizing profits over safety, declining aircraft sales, and a mounting debt load.

With the current strike, the company faces yet another obstacle on its path to recovery, and all eyes are now on the ongoing negotiations to see if Boeing can turn the tide.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)