Advertisement|Remove ads.

BAC Stock Gains On Bullish Q4 Print – Guides For Mid-Single Digit NII Growth In FY26

- Diluted earnings per share beat Street expectations, coming in at $0.98 versus estimates of $0.95.

- Net interest income (NII) advanced 10% to $15.8 billion, driven by Global Markets activity.

- Credit quality improved, with provisions for credit losses declining to $1.3 billion.

Bank of America (BAC) delivered a stronger-than-expected fourth quarter, with revenue of $28.4 billion topping Wall Street forecasts of $27.7 billion, according to Fiscal.ai. Diluted earnings per share also beat expectations, coming in at $0.98 versus estimates of $0.95.

BAC shares were up 1.8% in premarket trading on Wednesday but dropped 5% after the opening bell.

Q4 revenue climbed 7%, supported by higher net interest income, asset management fees, and sales and trading activity. Net interest income (NII) advanced 10% to $15.8 billion, driven by Global Markets activity and higher loan and deposit balances, though partially offset by lower interest rates.

Credit quality improved, with provisions for credit losses declining to $1.3 billion and net charge-offs trending lower. Expenses increased slightly due to investments in technology, talent, and growth initiatives.

“With consumers and businesses proving resilient, as well as the regulatory environment and tax and trade policies coming into sharper focus, we expect further economic growth in the year ahead. While any number of risks continue, we are bullish on the U.S. economy in 2026,” said Chair and CEO Brian Moynihan.

2026 Outlook

Looking ahead, Bank of America expects FY26 net interest income to grow 5% - 7%, with a 7% NII growth outlook for the first quarter (Q1). The outlook assumes fixed-rate asset repricing continues alongside steady loan and deposit growth, the bank said. Other income is projected at $100 million to $300 million per quarter, with an effective tax rate near 20%.

How Did Stocktwits Users React?

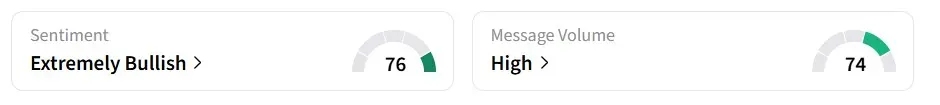

Despite the sharp intra-day decline, retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘neutral’ a day earlier, amid 'high' message volumes.

Other banking giants have reported mixed Q4 results, with JPMorgan Chase & Co (JPM) posting a better-than-expected revenue of $46.8 billion, while Wells Fargo’s $21.29 billion revenue fell short of Wall Street estimates of $21.68 billion, according to Fiscal.ai data.

Over the past year, BAC shares have gained around 14%.

Read also: WFC Stock Sees Red In Pre-Market As Investors Weigh Revenue Miss Against Improving Growth Signals

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2238737789_jpg_eca1ed4bd9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)