Advertisement|Remove ads.

Bajaj Electricals Sees Biggest Intraday Rally Since May On Morphy Richards Acquisition

Shares of Bajaj Electricals surged 13.3% on Wednesday after it announced the acquisition of Morphy Richards. It was the biggest intra-day gain since May 12 this year.

On Tuesday, Bajaj Electrical’s board approved a proposal to acquire the ‘Morphy Richards’ brand and related intellectual property rights in India, Nepal, Bhutan, Bangladesh, the Maldives, and Sri Lanka from Glen Electric Limited, part of Ireland’s Glen Dimplex Group.

The acquisition, valued at ₹146 crore, will give the company exclusive rights to the Morphy Richards brand across these territories.

The acquisition will complement Bajaj Electrical’s existing line of kitchen and household electrical products, including toasters, cookers, irons, and vacuum cleaners, among others.

Low Demand Sinks Q1 Profit

Bajaj Electricals reported a 96.8% slump in first-quarter profit to ₹9.1 million, compared to ₹281.1 million a year earlier. The company incurred a one-time expense of ₹66.8 million, related to ex gratia for its Nashik factory. Before the exceptional item, profit fell 76.7% in the quarter.

Net sales fell 8.1% to ₹10.59 billion, with revenue from the consumer segment declining 10.8%. The results were affected by lower demand for its home appliances.

Retail Watch

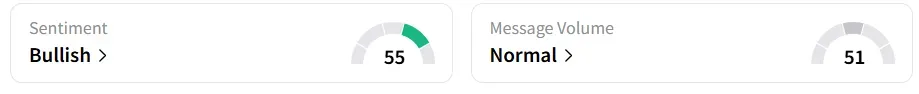

Retail sentiment on Stocktwits turned ‘bullish’ since the acquisition was announced. It was ‘neutral’ before that.

The stock has been under heavy selling pressure this year, having lost a fifth of its value in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)