Advertisement|Remove ads.

Bakkt Stock Rises After Q1 Profit Swing, Retail Sees ‘Explosive Growth’ After Underperformance

Bakkt (BKKT) stock jumped 13.8% in extended trading on Monday after the company swung to a net income during the first quarter after cutting its operating expenses.

The cryptocurrency trading platform said it reported a net income of $16.2 million for the quarter ended March 31, compared to a year-ago loss of $21.3 million, in the year-ago quarter.

Bakkt said its crypto-enabled accounts rose 7.9% to 6.8 million in the first quarter. In comparison, total transacting accounts remained relatively flat year-over-year and declined 20.1% sequentially, tracking broader declines in activity.

The firm’s assets under custody jumped 52.5% year-over-year to $1.87 billion, primarily due to higher trading prices for crypto assets.

Digital asset prices have remained extremely volatile following a surge after Donald Trump was elected as the U.S. President.

Bakkt has undergone a strategic overhaul this year to trim expenses. It agreed to sell its qualified custodian subsidiary, Bakkt Trust Company, and is also exploring strategic alternatives for its loyalty business segment, including a potential sale or wind-down.

In March, it placed a bet on stablecoins by signing a cooperative agreement with Distributed Technologies Research (DTR) to combine its crypto trading platform with DTR’s stablecoin payments platform. The deal is expected to be finalized by the third quarter.

"With our planned strategic divestitures of non-core assets and our collaboration with DTR, we're sharpening our focus on our fundamental crypto strengths,” co-CEO Andy Main said.

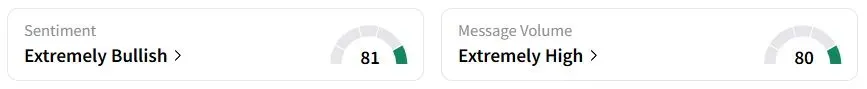

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (81/100) territory, while retail chatter was ‘extremely high.’

One user said people might have to wait until next year to “begin seeing the money,” but the current stock price is a “fantastic buy for anybody just getting in.”

Another user expected an “explosive growth” after years of underperformance.

Bakkt stock has fallen 60.4% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239275331_jpg_81be89c46a.webp)