Advertisement|Remove ads.

Banco Products Shares: SEBI RA Ashok Kumar Aggarwal Eyes ₹745 Target

Banco Products (India) is showing strong bullish momentum on the technical charts across multiple timeframes.

The relative strength index (RSI) on the daily, weekly, and monthly charts stands above 60, indicating positive momentum with room for further buying, according to SEBI-registered analyst Ashok Kumar Aggarwal.

The Chande Momentum Oscillator (CMO), a technical indicator that measures the strength and direction of momentum, is above +25, indicating sustained buying interest.

Banco Products stock broke above a key resistance level earlier this month, signaling potential for further upside in the short to medium term, the analyst noted.

Aggarwal said the ideal accumulation zone lies between ₹615 and ₹640, with a stop loss at ₹555 to manage downside risk. If the current trend continues, the stock is well-positioned to reach a target of ₹745, a 21% upside.

The stock is currently trading at ₹654.65.

Fundamentally, Banco Products remains robust with a strong presence in both domestic and international markets for engine cooling systems. It has an ROCE of 33.4%, ROE of 33.3%, and trades at a PE of 23.9.

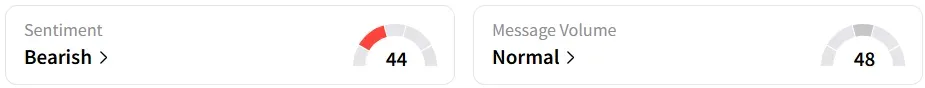

However, retail sentiment on Stocktwits remained ‘bearish’. It was ‘bullish’ a week earlier.

The stock has seen heavy buying interest year-to-date, gaining 37.46%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_optoelectronics_wafer_production_resized_759caf364b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_duolingo_resized_jpg_b62f52b726.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_purple_jpg_faad1be151.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259270325_jpg_4fbb248789.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)