Advertisement|Remove ads.

Bandhan Bank Shares: SEBI RA Sees Upside To ₹200, All Eyes On Q1 Earnings This Week

Bandhan Bank gained 3% on Tuesday, as the private sector bank gears up to declare its first-quarter (Q1 FY26) earnings on July 18.

Earlier this month, in its Q1 provisional update, the bank reported mixed trends. Loans & advances decreased by 2.5% quarter-on-quarter (QoQ) but increased 6.4% year-on-year (YoY), reaching ₹133,635 crore.

Total Deposits grew 2.3% QoQ & 16.1% YoY to ₹154,664 crore. Retail Deposits (incl CASA) rose 1.3% QoQ & 14.6% YoY. Collection efficiency was stable.

SEBI-registered analyst Deepak Pal noted that the stock witnessed a decline from higher levels over the past two weeks, but continued to hold strong support near its 14-day and 55-day Exponential Moving Averages (EMAs) on its weekly chart, indicating underlying strength.

The Moving Average Convergence Divergence (MACD) remains below the signal line but is showing signs of stability.

On the daily chart, Bandhan Bank is taking support near its 50-day moving average.

Technically, the stock is holding above ₹175, maintaining a positive trend. Pal suggested that any dip toward this support zone could be a buying opportunity.

For the short term, traders can consider an entry with a stop loss at ₹165, and on the upside, the stock has the potential to move toward ₹195–₹200 levels, according to Pal.

On the fundamentals, he noted that the bank maintains a healthy Net Interest Margin (NIM) of 7.3% owing to its microfinance-heavy portfolio. However, its asset quality remains a key concern, with Gross Non-Performing Assets at 4.87%.

With a comfortable capital adequacy ratio of 18.3% and YoY advances growth of 14%, Bandhan Bank is in a gradual transition toward secured lending and portfolio diversification, according to Pal.

However, regional concentration and earnings volatility due to provisioning remain challenges. The outlook depends on sustained improvement in asset quality and business diversification.

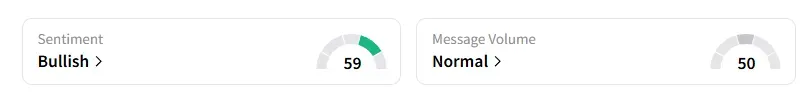

Data on Stocktwits shows that retail sentiment has been ‘bullish’ for a week.

Bandhan Bank shares have risen 14% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)