Advertisement|Remove ads.

Goldman Sachs, Citigroup, Bank Of America: Retail Sentiment Brightens For Big Bank Stocks Ahead Of Q3 Earnings

Bank earnings kicked-off on Friday with JPMorgan, Wells Fargo and BNY Mellon reporting strong third-quarter results. This week, investors are eyeing quarterly earnings from some of the largest banks in the U.S. that include Goldman Sachs, Citigroup Inc and Bank of America. Here’s a preview of their earnings:

Goldman Sachs (GS): The bank is expected to report revenue of $11.757 billion during the quarter, slightly higher than the $11.13 billion it reported in the same quarter a year ago. Analysts estimate earnings per share of $7.31 versus $5.52 reported last year.

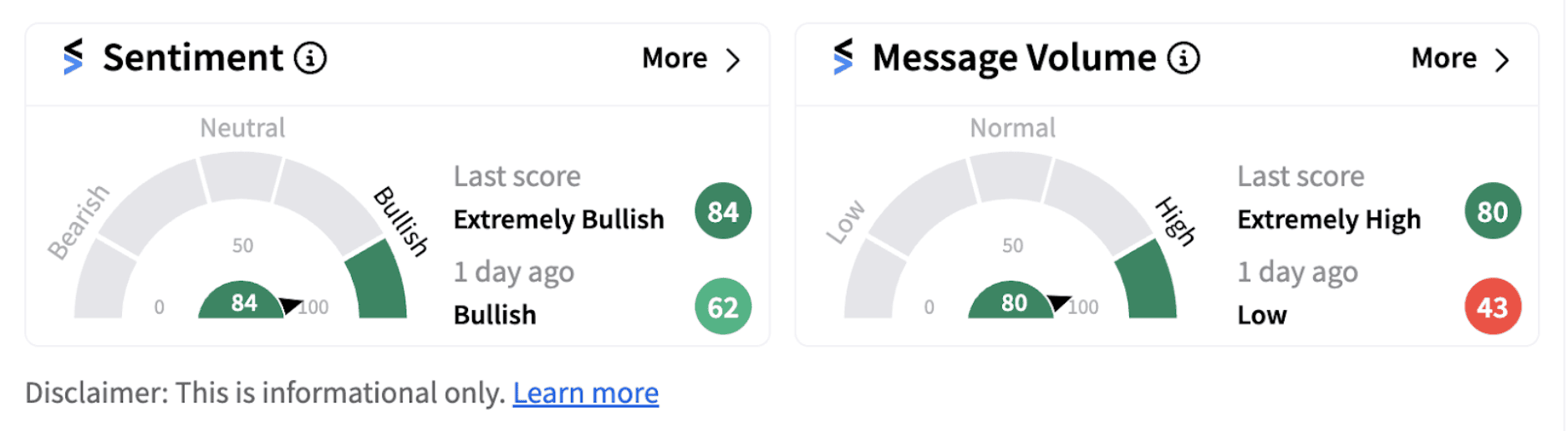

On Monday morning, retail sentiment on Stocktwits climbed into the ‘extremely bullish’ territory (84/100) from ‘bullish’ a day ago.

Citigroup (C): Citigroup is expected to report revenue of $19.825 billion during the quarter compared to $19.268 billion posted in the same period a year ago. EPS is expected to come in at $1.31 versus $1.22 last year.

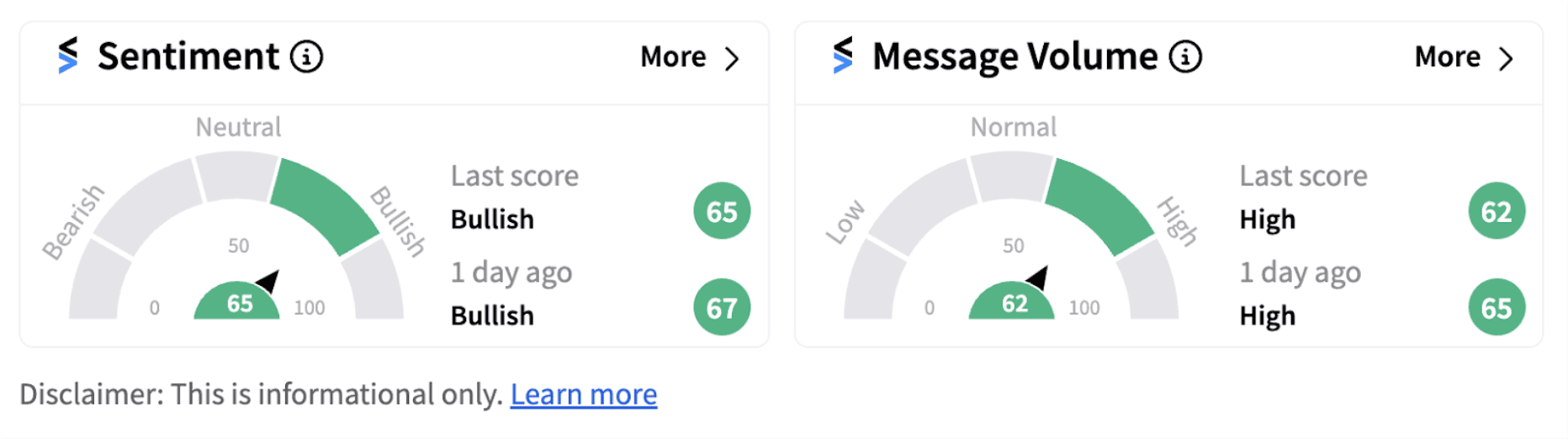

Ahead of the earnings report, retail sentiment on Stocktwits continued to trend in the ‘bullish’ territory, accompanied by ‘high’ message volumes.

Bank of America (BAC): The firm has been in focus lately after Warren Buffett’s Berkshire Hathaway reduced its stake in the lender below 10%. The bank is expected to report revenue of $25.23 billion compared to $25.07 billion in the same period a year ago. Analysts expect EPS to come in at $0.78 versus $0.81 in the same quarter a year ago.

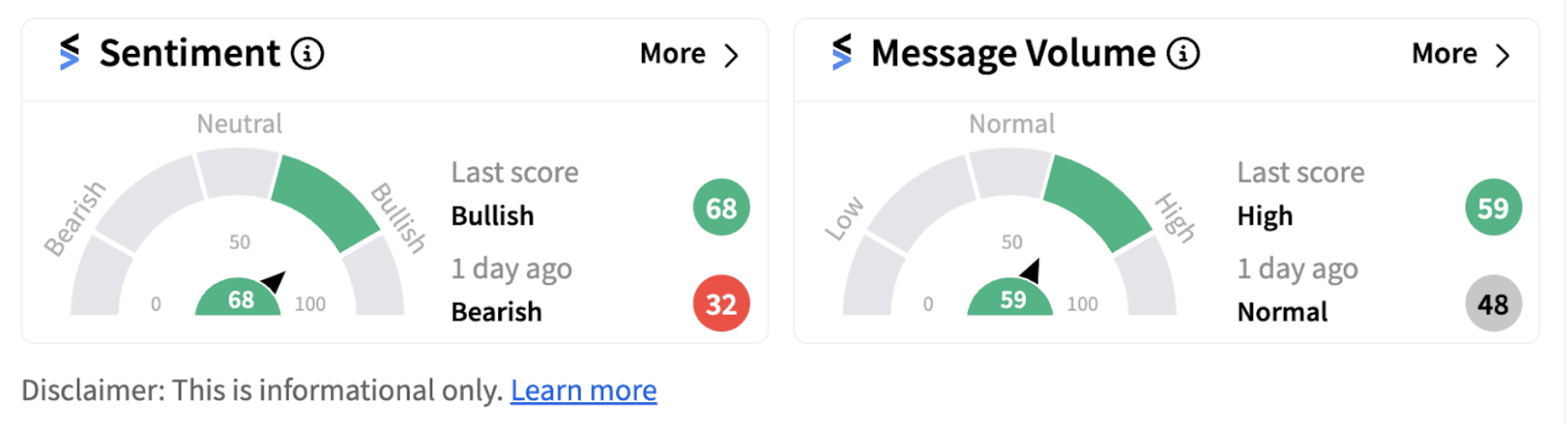

Meanwhile, retail sentiment on Stocktwits jumped into the ‘bullish’ territory (68/100) from ‘bearish’ a day ago, accompanied by high retail chatter.

Also See: JPMorgan Chase Stock In Focus After Multiple Price Target Hikes: Retail Turns Extremely Bullish

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)