Advertisement|Remove ads.

JPMorgan Chase Stock In Focus After Multiple Price Target Hikes: Retail Turns Extremely Bullish

After reporting better-than-expected third-quarter earnings last week, JPMorgan Chase & Co (JPM) stock was in the spotlight on Monday morning as it received multiple brokerage upgrades.

Morgan Stanley reportedly raised its price target on JPMorgan to $237 from $224, while keeping an ‘Equal Weight’ rating on the shares. The brokerage highlighted the bank’s high quality beat across net interest income, fees and expenses and expects the lender will deliver above-consensus $89 billion in net interest income ex-markets and over $92 billion in total net interest income in 2025.

JPMorgan shares had closed over 4% higher on Friday after the firm reported upbeat results. Revenue came in at $43.32 billion versus an estimated $41.63 billion while earnings per share (EPS) came in at $4.37 compared to an estimated $4.01.

Net interest income, the difference between interest earned and interest expended, rose 3% to $23.5 billion surpassing an estimate of $22.73 billion.

Not surprisingly, analysts now expect the stock to rally further than their earlier projections. Barclays has reportedly raised its price target on the lender to $257 from $217, while keeping an ‘Overweight’ rating on the stock. The brokerage noted that JPMorgan improved its 2024 NII and expense guides, but expects a decline in NII and a rise in expenses in 2025.

Interestingly, JPMorgan CEO Jamie Dimon presented a dour outlook despite posting upbeat earnings. Talking about the current geo-political situation, Dimon said conditions are treacherous and getting worse and that the outcome of these situations could have far-reaching effects on both short-term economic outcomes and more importantly on the course of history.

“Additionally, while inflation is slowing and the U.S. economy remains resilient, several critical issues remain, including large fiscal deficits, infrastructure needs, restructuring of trade and remilitarization of the world. While we hope for the best, these events and the prevailing uncertainty demonstrate why we must be prepared for any environment,” Dimon said.

Notably, one of the highlights of the bank’s earnings came in the form of a 31% jump in its investment banking fees during the quarter, driven by higher fees across all products. Markets revenue, too, rose 8% to $7.2 billion.

Meanwhile, Goldman Sachs, too, raised its price target on JPMorgan to $251 from $237, while keeping a ‘Buy’ rating on the stock. However, the brokerage noted that the management's 2025 NII and expense trajectory are "generally conservative.”

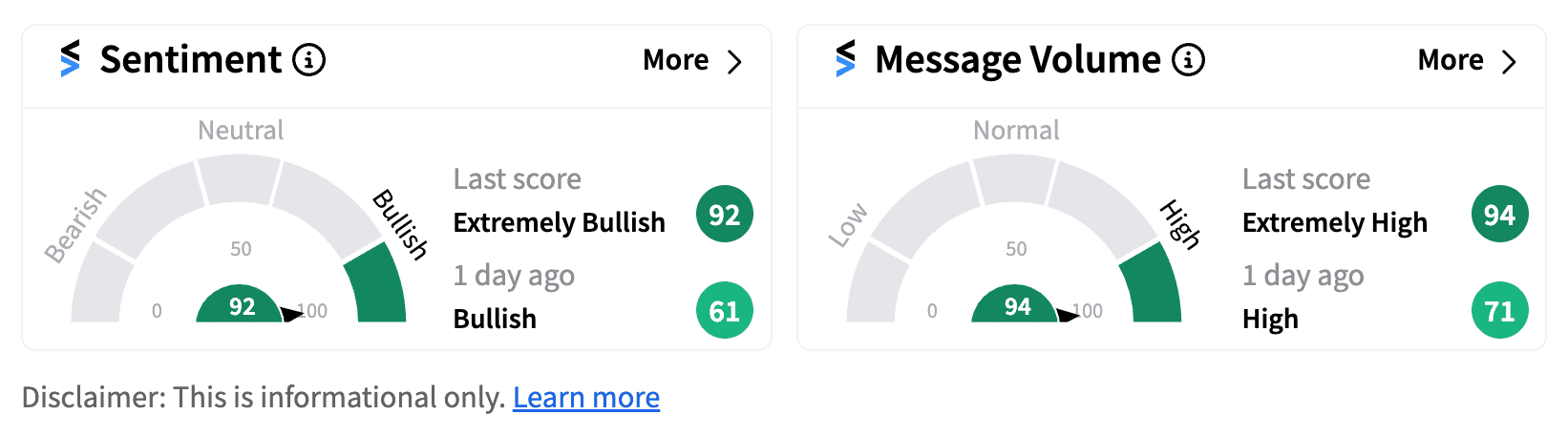

Shares of JPMorgan were trading marginally in the green during Monday’s pre-market session. Retail sentiment on Stocktwits inched up into the ‘extremely bullish’ territory (92/100) from ‘bullish’ a day ago.

One Stocktwits user with a bearish outlook believes the stock may fall to the $200 level soon.

Another user with a bullish view thinks the stock is set for a gradual rally.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)