Advertisement|Remove ads.

Bank Of America Gets An Upgrade, Price Target Hike By Baird: Retail Optimism Rises Despite Stock Slipping Below 200-Day SMA

Bank of America Corp. (BAC) shares drew investor attention on Friday after Baird upgraded the stock to ‘Outperform’ from ‘Neutral’ while raising the price target to $50 from $45.

The new price target implies a 21% upside for the stock from current levels.

The upgrade comes as Bank of America's stock has dipped below its 200-day simple moving average (SMA), a key technical level. The stock closed below the average on March 5 for the first time since November 2023.

According to TheFly, Baird noted that the risk-reward ratio in the U.S. bank group has improved after this week's weakness in share prices. The recent weakness in the bank group has created an opportunity to get more constructive, it added.

Baird also said the upside potential "finally outweighs downside risk in several bank names as the election euphoria has faded and then some.”

Bank of America is a "great franchise at a reasonable price,” the brokerage highlighted.

The lender performed well in the first quarter (Q1), reporting earnings per share (EPS) of $0.82 compared to a Wall Street estimate of $0.77.

Revenue rose 15% year-over-year (YoY) to $25.5 billion versus an analyst estimate of $25.19 billion. The increase was primarily led by higher asset management and investment banking fees and sales and trading revenue.

Net interest income, the difference between interest earned and expended, rose 3% YoY to $14.4 billion. The lender expects first-quarter NII of $14.5 billion to $14.6 billion.

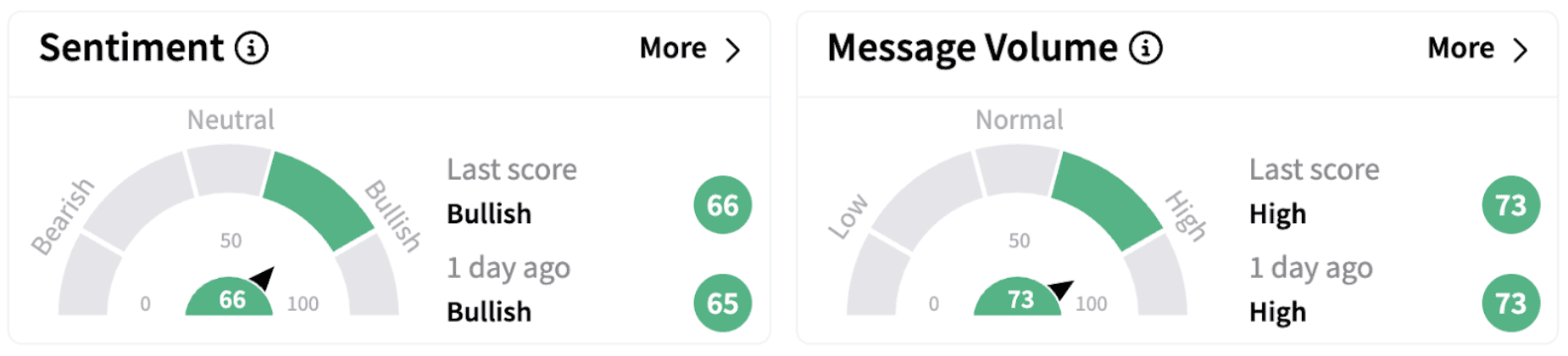

Meanwhile, on Stocktwits, retail sentiment climbed further into the ‘bullish’ territory (66/100), accompanied by ‘high’ message volume.

BAC shares have lost over 6% in 2025 but are up over 16% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JP_Morgan_JPM_resized_jpg_5def7e91d0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240044381_jpg_d366402b12.webp)