Advertisement|Remove ads.

Bank Of Baroda Stock Maintains Bullish Technical Structure Ahead Of Q1 Results; SEBI RA Sees Upside Above ₹250

Bank of Baroda is set to report its Q1FY26 earnings later in the day, with reports indicating that the PSU bank could post a weak set of numbers due to poor interest income and low treasury gains.

Bank of Baroda is expected to declare a net profit of ₹18,467 crore, a net interest income of ₹48,115 crore, and a net interest margin of 2.69%, according to reports.

Despite the soft earnings expectations, the stock’s technical setup remains constructive.

After breaking out of a multi-year cup & handle pattern on the monthly chart and hitting an all-time high of ₹281.80 in 2024, the stock is now consolidating near ₹239, noted SEBI-registered analyst Rohit Mehta.

The analyst believes that the pause in momentum is healthy, as long as it sustains above the strong support zone of ₹170 - ₹180. A decisive move above ₹250 could revive upward momentum, with the long-term structure still bullish.

Bank of Baroda shares were 0.5% higher at ₹248.32 on Friday’s early trade.

From a fundamental perspective, the stock’s valuations remain attractive at 0.85x book value, and it has a dividend yield of 3.45%. However, concerns remain around its contingent liabilities, rising working capital days, and a low interest coverage ratio.

Its financial performance has been mixed in recent quarters. Last quarter, revenue rose 4.1%, but financing profit turned negative. Sequentially, profit before taxes dipped marginally by 0.35%, while EPS showed improvement, rising 3.97% sequentially and 5.65% year-on-year.

On the shareholding front, promoter stake remained unchanged at 63.97%. FIIs trimmed their holdings from 8.98% to 8.08%, while DIIs increased their stake to 18.79%.

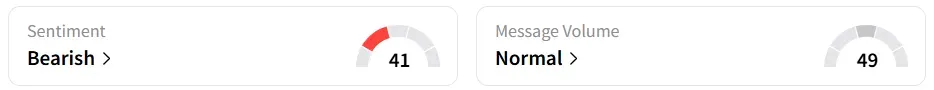

Ahead of the results, retail sentiment on Stocktwits shifted to ‘bearish’ from ‘neutral’ a week earlier.

Year-to-date, the stock has gained a marginal 3.3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)