Advertisement|Remove ads.

Bark’s Bite Weakens: Pet Supplies Retailer Faces NYSE Delisting Risk After Prolonged Stock Slump

Pet products retailer Bark (BARK) said late Friday that it had received a notice from the New York Stock Exchange (NYSE) over its noncompliance with the minimum stock price requirement.

The company noted that the average closing price of its stock was less than $1 over the prior 30 trading-day period and said it would consider all available options to regain compliance.

Bark shares were up 0.8% to $0.93 in extended trading on Friday.

Bark went public in December 2020 after merging with special-purpose acquisition company (SPAC) Northern Star Acquisition Corp. As of the last close, the company's share price is down over 90% from its $13 IPO price.

In recent years, Bark has seen its business shrink due to competition in the pet supplies space and waning demand for BarkBox/Super Chewer subscriptions.

U.S. tariffs have added to the headwinds. Last month, Bark skipped providing full-year guidance, citing the "ongoing uncertainty surrounding potential tariffs and their impact on overall demand and operating costs."

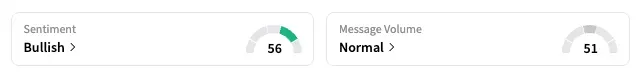

On Stocktwits, the retail sentiment for Bark remained in the 'bullish' zone, unchanged from a week ago. BARK shares are down 50.7% year-to-date.

Users expressed frustration at the company's management, saying that CEO Matt Meeker had done little in terms of product development or promotions.

Last year, Bark expanded its retail footprint by selling directly on Chewy (CHWY) and Target (TGT). The company also sells its products via Amazon.com (AMZN).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Consumer Stock Standouts: Tapestry, Dollar Tree, Wynn Resorts Emerge As Top Weekly Winners

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244672917_jpg_95b721e1af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195597245_jpg_c1df83b829.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paypal_BTC_ETH_OG_jpg_566a59dd7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2189355808_jpg_c13dd12a0f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195599761_jpg_ec0e618b8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)