Advertisement|Remove ads.

Barrick Mines A Rally On Trump Tariff Threats As Gold Fever Strikes Again

Barrick Gold (GOLD) shares climbed more than 2% on Monday morning as gold prices surged to a new record, driven by renewed demand for safe-haven assets following President Donald Trump’s latest tariff threats.

The stock was among the top trending tickers on Stocktwits as its price hit near two-month highs, fueled by gold prices reaching an all-time high of $2,911.30 per troy ounce – marking the seventh record peak in 2025 and bringing the glittering $3,000 milestone into view.

Gold’s price is already up nearly 11% this year after a staggering 27% gain in 2024.

Trump is expected to introduce a 25% tariff on all steel and aluminum imports later on Monday, followed by reciprocal tariffs on Tuesday or Wednesday. These measures would apply to all countries and match the tariff rates imposed by each.

The prospect of new trade restrictions has heightened concerns about inflation and potential trade wars, fueling demand for gold, traditionally seen as a hedge against economic and geopolitical instability.

The SPDR Gold Trust (GLD) rose 1.4%, while the broader materials sector also rallied, with the SPDR S&P Metals & Mining ETF (XME) gaining over 3.5%.

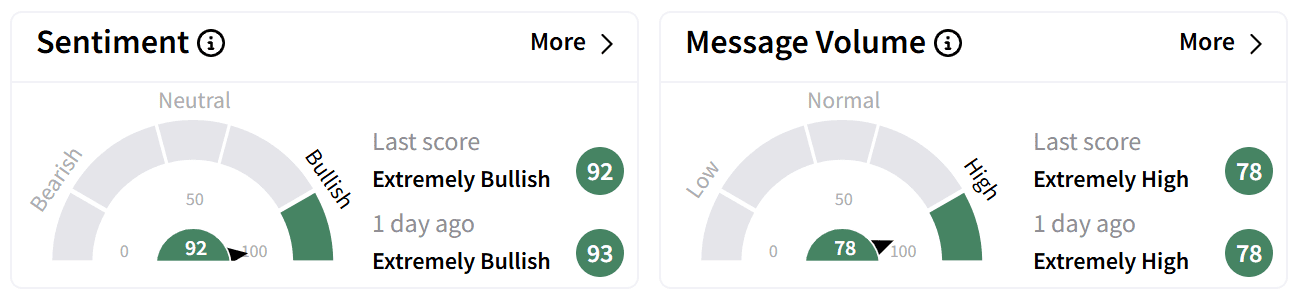

On Stocktwits, retail sentiment around Barrick Gold remained ‘extremely bullish’ accompanied by ‘extremely high’ chatter.

One user projected the stock could reach $21 if gold’s rally continues and Barrick delivers strong earnings. The company will report quarterly results on Feb. 12.

Last week, Barrick Gold announced a significant increase in its mineral reserves for 2024. The company’s attributable proven and probable gold reserves rose 23% to 89 million ounces at 0.99 grams per ton, driven mainly by its Reko Diq copper-gold project, which added 13 million ounces.

Copper reserves surged 224% year-over-year to 18 million tonnes at 0.45%, following feasibility studies at the Lumwana and Reko Diq projects.

The company reported replacing more than 180% of its depleted gold reserves since 2019, adding nearly 46 million ounces at an average cost of $10 per ounce.

Barrick shares have gained 18% over the past year, with more than 10% of those gains occurring in 2025. However, the company remains entangled in a dispute with the Mali government over its Loulo-Gounkoto mine operations.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Cleveland-Cliffs Stock Soars On Trump’s Steel Tariff Promise: Retail Anticipates Bigger Gains

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kalshi_logo_jpg_d4ea268948.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1249125319_jpg_31d1207b8e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)