Advertisement|Remove ads.

Cleveland-Cliffs Stock Soars On Trump’s Steel Tariff Promise: Retail Anticipates Bigger Gains

Cleveland-Cliffs Inc. (CLF) shares surged more than 12.5% in early trading Monday after U.S. President Donald Trump pledged to impose a 25% tariff on imported steel and aluminum.

The rally pushed the stock to its highest level since December and made it one of the top trending tickers on Stocktwits.

Shares of peers U.S. Steel Corp. (X) and Nucor Corp. (NUE) also climbed, rising about 5% each.

The President told reporters that the proposed levies would apply to all countries exporting the metals to the U.S.

He said he would announce the new tariffs on Monday, along with “reciprocal tariffs” on Tuesday or Wednesday on countries that have imposed levies on U.S.-made goods.

If enacted, the tariffs would make it more expensive for foreign steelmakers to sell in the U.S., giving domestic producers, like Cleveland-Cliffs, a competitive advantage and potentially allowing them to raise prices.

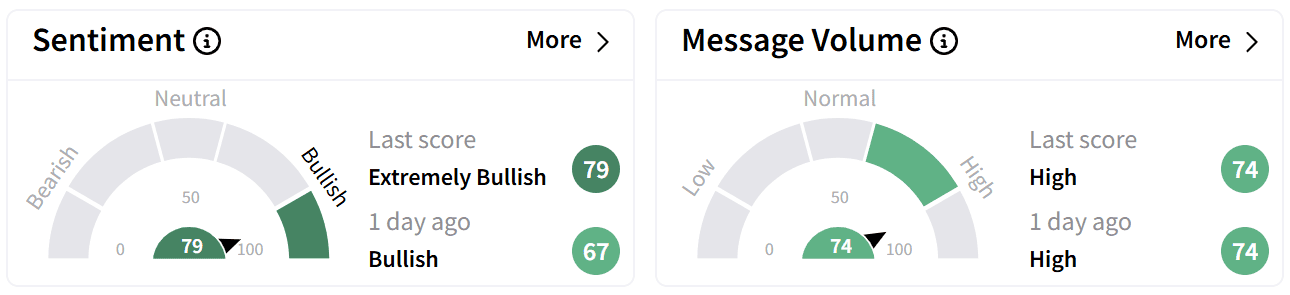

Retail sentiment on Stocktwits also improved to ‘extremely bullish’ from ‘bullish’ a day ago, as chatter remained at ‘high’ levels.

Traders on the platform largely viewed the tariff proposal as a tailwind for Cleveland-Cliffs, which has been vying to expand its market position.

CEO Lourenco Goncalves drew criticism last month after making inflammatory remarks about Japan during a press conference, where he reiterated the company’s interest in acquiring U.S. Steel while attempting to discredit Japanese firm Nippon Steel’s competing bid.

And, just last week, the stock tumbled after the company’s preliminary fourth-quarter results disappointed investors.

Cleveland-Cliffs’ stock is down over 42% in the last 12 months but up 18% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: These 3 Materials Stocks Led Retail Chatter Last Week

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2237643016_jpg_17a9a7eb9d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221557373_jpg_2cb3ed82cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2251311021_jpg_31a407e714.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aluminum_resized_jpg_6efa759339.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)