Advertisement|Remove ads.

Beauty Retailer Coty Is Reportedly Looking To Sell Its Business: Retail Sentiment Jumps

Coty's (COTY) shares rose nearly 7% on Monday, after a report said the beauty company is exploring the sale of its business.

Fashion trade publication WWD reported the company is seeking buyers for its luxury segment, which features brands such as Hugo Boss, Gucci, and Burberry, and its consumer division, which includes CoverGirl and Max Factor.

One potential buyer for Coty's luxury business is perfume maker Interparfums. However, the report, which cited multiple industry sources, states that the talks are at an early stage.

Like many retailers, Coty has recently faced soft demand amid persistent inflation and, more recently, the added pressure of U.S. tariffs, which threaten to drive up costs and further strain consumer spending.

Last month, the company cut its 2025 profit forecast and postponed its investor day event, citing macroeconomic and tariff uncertainties.

U.S. President Donald Trump’s unpredictable trade policies have heightened recession fears, prompting consumers to spend more cautiously on discretionary items, such as beauty products.

Coty had admitted that the sale of beauty products decelerated from the first half of fiscal year 2025.

The company declined to comment on the report in a statement to Reuters.

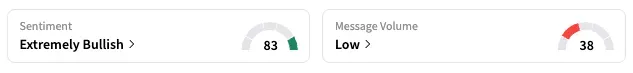

On Stocktwits, the retail sentiment shited to 'extremely bullish' from 'bullish' the previous day.

Several users posted about the surge in stock following the deal news, with one saying the stock will rise to over $6.

One user suggested that a buyout could be the best-case scenario for Coty, noting that its owner, JAB Holding (Reimann family), may be seeking liquidity, particularly as another portfolio company, Krispy Kreme, is also facing headwinds.

Coty shares are down 27.4% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2147920616_jpg_ab875c9370.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cybercab_resized_jpg_1588e769f9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_zim_shipping_jpg_42b726c79d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)